Overview

The Non-depository Credit Intermediation Industry encompasses a range of financial activities where entities facilitate borrowing and lending without holding deposits. In this industry, organizations such as credit unions, mortgage lenders, finance companies, and peer-to-peer lending platforms play a vital role in connecting borrowers with lenders. These intermediaries help individuals and businesses access credit and funding sources, often by providing loans, credit lines, and various financing solutions. Unlike traditional depository institutions like banks, entities in this industry do not accept deposits from customers. Instead, they focus on matching borrowers’ needs with available sources of credit, fostering economic growth by enabling access to capital for diverse purposes such as home purchases, business expansions, and personal financing.

GAO’s RFID, BLE, IoT, and drone technologies have helped its customers in Non-depository Credit Intermediation Industry to improve their work processes, their operations and productivity by better management of their staff, materials and operational equipment such as Computers and Laptops, Servers and Data Storage, Networking Infrastructure, Printers and Scanners, Telecommunication Systems, Software Applications, Security Systems, Office Furniture, Document Management Systems, Point-of-Sale (POS) Terminals, ATMs (Automated Teller Machines), Data Analytics Tools, Customer Service Tools, Presentation Equipment, Backup and Disaster Recovery Solutions, Mobile Devices, Security Equipment, Office Supplies, Cash Handling Equipment, Compliance and Regulatory Tools.

Ranked as one of the top 10 global RFID suppliers, GAO RFID Inc. is based in New York City, U.S. and Toronto, Canada. GAO offers a comprehensive selection of UHF, HF (including NFC) and LF RFID (radio frequency identification) readers and tags, BLE (Low Energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), traceability. Such RFID and BLE products and systems, as well as its IoT and drone technologies, have been successfully deployed for Non-depository Credit Intermediation Industry. Its sister company, GAO Tek Inc. https://gaotek.com, is a leading supplier of industrial or commercial testers and analyzers, drones, and network products.

Applications & Benefits of GAO’s RFID, BLE, IoT & Drones for Non-depository Credit Intermediation Industry

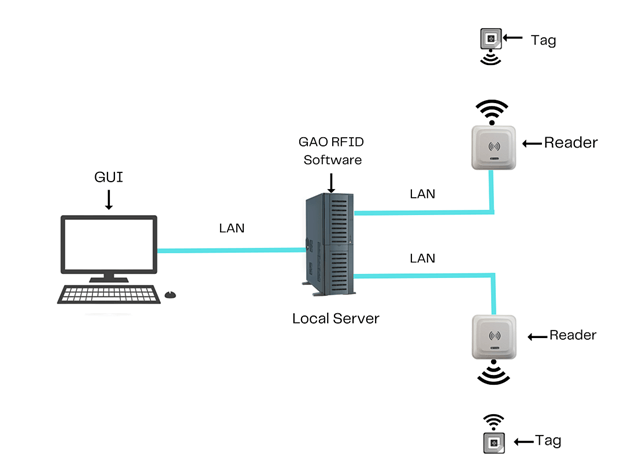

To satisfy its customers, GAO’s RFID or RFID Systems for Non-depository Credit Intermediation Industry are offered in 2 versions. One version is that its software is running on a local server that normally is on our client’s premises, and another version runs in the cloud. The cloud server could be GAO’s cloud server, client’s own cloud server or a cloud server from one of the leading cloud server providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud (formerly SoftLayer), Oracle Cloud, RedHat, Heroku, Digital Ocean, CloudFlare, Linode and Rackspace. The above illustrates GAO system for Non-depository Credit Intermediation Industry with its software running on a local server.

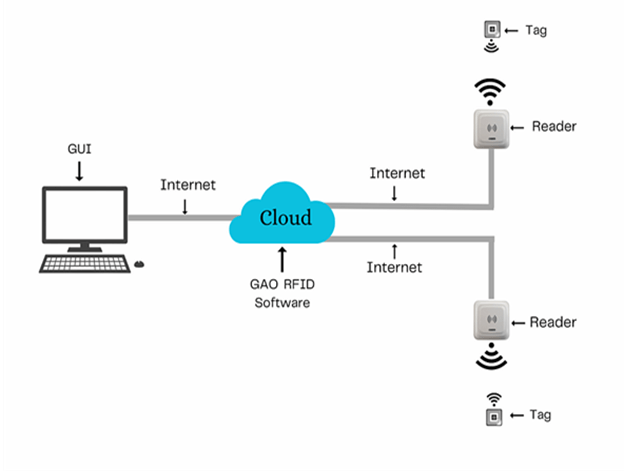

The above illustrates GAO system for non-depository credit intermediation industry with its software running in cloud.

GAO’s RFID and BLE technologies, consisting of RFID readers, RFID tags, BLE gateways, BLE beacons, software, cloud services and their systems, have the following applications in Non-depository Credit Intermediation Industry:

- Peer-to-Peer (P2P) Lending: P2P lending platforms facilitate direct lending between individuals or businesses without the involvement of traditional financial institutions. Borrowers can access loans at competitive rates, while lenders can earn interest on their investments.

- Online Lenders: Online lenders offer various types of loans, such as personal loans, small business loans, and student loans, through digital platforms. These lenders often use advanced algorithms and data analytics to assess creditworthiness and make lending decisions quickly.

- Consumer Finance Companies: These companies offer installment loans, credit cards, and other types of consumer credit to individuals. They often serve customers who may not qualify for traditional bank loans.

- Commercial Finance Companies: Commercial finance companies provide financing solutions to businesses, including equipment leasing, working capital loans, and trade finance.

- Microfinance Institutions: Microfinance institutions extend small loans to low-income individuals and entrepreneurs in developing countries to support their business ventures and improve their living standards.

- Factoring Services: Factoring companies purchase accounts receivable from businesses at a discount, providing them with immediate cash flow and handling the collection of the receivables from customers.

- Merchant Cash Advance Providers: These providers offer cash advances to businesses based on their future credit card sales, enabling them to access working capital quickly.

- Payday Lenders: Payday lenders offer short-term, high-interest loans to individuals, often intended to cover emergency expenses until the borrower’s next paycheck.

- Crowdfunding Platforms: Some crowdfunding platforms operate in the lending space, allowing individuals and businesses to raise funds by borrowing from a crowd of investors who expect a return on their investment.

- Equipment Financing Companies: These companies specialize in providing loans and leases for the acquisition of equipment and machinery needed by businesses.

GAO’s drone technologies find the following applications in the Non-depository Credit Intermediation industry:

- Smart Loan Origination: IoT can be used to collect data from connected devices such as smartphones, wearables, and smart home devices to assess the creditworthiness of potential borrowers. This data can include spending habits, income patterns, and behaviour analysis, allowing lenders to make more informed lending decisions.

- Usage-Based Lending: IoT devices can track the usage of assets financed by the lender, such as vehicles or equipment. Based on usage data, lenders can offer personalized loans with flexible repayment terms, depending on how often the assets are used or the revenue generated.

- Real-time Risk Management: IoT sensors can continuously monitor the health and performance of assets pledged as collateral for loans. This real-time monitoring allows lenders to assess risks associated with the assets and take timely actions to protect their interests.

- Automated Payment Collection: IoT-enabled devices can facilitate automated payment collection from borrowers, ensuring timely payments and reducing the risk of default.

- Fraud Prevention: IoT devices can enhance security measures by implementing multi-factor authentication and continuous monitoring of user behaviour, reducing the risk of identity theft and fraudulent activities.

- Personalized Customer Service: IoT-generated data can help lenders understand their customers better, enabling them to offer more personalized products and services, leading to increased customer satisfaction and loyalty.

- Predictive Analytics: IoT data can be combined with machine learning algorithms to predict customer behaviours, assess credit risk, and anticipate market trends, allowing lenders to stay ahead of the competition and make better business decisions.

- Remote Asset Management: IoT devices can remotely monitor and manage the performance of assets financed by the lender, reducing the need for physical inspections and maintenance costs.

- Micro-lending and Peer-to-peer lending: IoT can facilitate micro-lending and peer-to-peer lending platforms, where individuals can borrow and lend small amounts of money. IoT data can be used to assess creditworthiness and track loan repayments.

- Digital Wallets and Payments: IoT can enable secure and seamless digital payment systems, reducing the reliance on cash transactions and enhancing overall financial inclusion.

GAO’s IoT technologies, consisting of IoT sensors, sensors networks and systems, find the following applications in the non-depository credit intermediation industry:

- Risk Assessment and Credit Scoring: IoT devices can collect real-time data on customer behavior, spending patterns, and other relevant factors. This data can be used to assess credit risk and create more accurate credit scores for individuals and businesses.

- Asset Tracking and Management: IoT-enabled sensors can be used to track and manage assets used as collateral for loans or credit. This includes tracking the location, condition, and usage patterns of vehicles, equipment, and other valuable items.

- Fraud Detection: IoT devices can help detect unusual or suspicious activities by monitoring transaction patterns, geolocation, and user behavior. This can aid in identifying and preventing fraudulent activities.

- Supply Chain Financing: IoT can be used to monitor and optimize supply chains, providing lenders with real-time visibility into the movement of goods. This can help streamline financing for suppliers and distributors.

- Peer-to-Peer Lending: IoT devices can facilitate peer-to-peer lending by securely verifying and sharing relevant borrower data among trusted parties, enabling smoother and more transparent lending processes.

- Insurance Premium Calculation: IoT-enabled devices like telematics in vehicles can collect data on driving behavior, allowing insurance companies to offer personalized premium rates based on actual usage and risk factors.

- Microfinance: IoT can help extend microfinance services to underserved populations by collecting data on repayment patterns, allowing lenders to offer small loans with reduced risk.

- Payment Systems and Point-of-Sale: IoT devices can enhance payment systems and point-of-sale processes, enabling seamless and secure transactions for customers and businesses.

- Customer Engagement: IoT devices can provide personalized offers, discounts, and financial advice based on customer behavior and preferences, enhancing customer engagement and loyalty.

- Automated Loan Processing: IoT data can be integrated into loan application processes, allowing for automated verification of collateral, assets, and financial health, speeding up loan approval and disbursement.

- Collection and Recovery: IoT devices can assist in asset recovery by providing location data and real-time tracking of delinquent assets, helping lenders efficiently reclaim collateral.

- Data Analytics for Lending Decisions: IoT-generated data can be analyzed using advanced analytics to gain deeper insights into borrower behavior and market trends, improving lending decisions and portfolio management.

- Smart Contracts: IoT can facilitate the creation and execution of smart contracts, automating loan agreements and ensuring compliance with predefined conditions.

- Customer Financial Health Monitoring: IoT devices can help individuals monitor their financial health by tracking spending habits, budget adherence, and savings goals, leading to better financial planning and management.

- Alternative Credit Scoring: For individuals without traditional credit history, IoT data can serve as an alternative source of credit information, enabling more inclusive lending practices

GAO Helps Customers Comply with Standards, Mandates & Regulations of Non-depository Credit Intermediation

GAO RFID Inc. has helped many companies in Non-depository Credit Intermediation industry to deploy RFID, BLE, IoT and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- ISO/IEC 18000 series

- ISO/IEC 14443

- EPC Gen2 (ISO/IEC 18000-63)

- NFC (Near Field Communication)

- Bluetooth Core Specification

- Bluetooth Low Energy (LE) Specification

- Generic Attribute Profile (GATT)

- CoAP (Constrained Application Protocol)

- OCF (Open Connectivity Foundation)

- oneM2M

- Zigbee

- ASTM F38

- EASA (European Union Aviation Safety Agency) Regulations

- CAA (Civil Aviation Authority) Regulations

- RFID mandates for non-depository credit intermediation

- RFID technology in finance

- Data security and privacy regulations for RFID in non-depository credit intermediation

- LoRaWAN

- Security Standards (e.g., TLS/SSL, DTLS, OAuth)

- BLE mandates or regulations for non-depository credit intermediation

- Data Privacy and Security

- Consumer Protection

- Industry Standards and Guidelines

- Compliance with Existing Laws

- Risk Management

- Product Liability and Safety

- IoT Device Lifecycle Management

- Incident Response and Notification

- International Compliance

- Collaboration with Regulators

- Drone Registration and Licensing

- Visual Line of Sight (VLOS)

- Data Privacy and Security for Drones

- Insurance Requirements for Drones

- No-Fly Zones and Sensitive Areas

- Flight Planning and Reporting

- Public Safety and Emergency Operations

US. Government Regulations

- Environmental Regulations

- Labor and Employment Regulations

- Financial Regulations

- Healthcare Regulations

- Consumer Product Safety

- Telecommunications Regulations

- Transportation Regulations

- Energy Regulations

Canadian Government Regulations

- Canadian Constitution

- Canadian Charter of Rights and Freedoms

- Federal Laws and Regulations

- Provincial and Territorial Regulations

- Environmental Regulations

- Employment Regulations

- Consumer Protection Regulations

- Privacy Regulations

- Health and Safety Regulations

- International Trade and Investment Regulations

GAO’s Software Provides API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in non-depository credit intermediation industry such as:

Personnel Management:

- HR Management System

- Workforce Scheduling Software

- Performance Management Software

Equipment Management:

- Asset Tracking Software:

- Equipment Maintenance Software

Access Control:

- Access Control Systems

- Identity and Authentication Management

Warehouse Management:

- Warehouse Management System (WMS)

- Inventory Control Software

Supply Chain Management:

- Supply Chain Planning Software

- Supplier Relationship Management (SRM)

Other Applications:

- CRM software

- Loan Origination System (LOS)

- Risk Assessment and Mitigation Software

- Business Intelligence (BI) Tools

- Compliance Management System

- Document Management System (DMS)

- Robotic Process Automation (RPA)

GAO has enabled its customers to make use of some of the leading software and cloud services in Non-depository Credit Intermediation Industry Below are some of popular software and cloud services in Non-depository Credit Intermediation Industry.

SAP Success, Factors, Workday, Oracle, HCM Cloud, ADP Workforce Now, BambooHR, Microsoft 365, Google Workspace, Amazon Web Services (AWS), Oracle NetSuite, SAP Extended Warehouse Management, Microsoft Dynamics 365 Supply Chain Management, Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), Oracle Cloud, Fiserv LoanComplete,Finastra Fusion Loan IQ,Wolters Kluwer Expere,Salesforce Financial Services Cloud, Microsoft Dynamics 365 for Finance and Operations, Oracle Financial Services Cloud, IBM Cloud.

GAO has worked with some of the leading technology companies in the Non-depository Credit Intermediation Industry to provide integrated RFID, BLE, IoT and drone solutions to customers. Here are some of the technology leaders in motor vehicle parts manufacturing industry: Non-depository Credit Intermediation Industry:

IBM, Oracle, SAP, Microsoft, Salesforce, Fiserv, Finastra, Wolters Kluwer, Ellie Mae, Mortgage Cadence, Cisco Systems, HP Inc. (Hewlett-Packard), Dell Technologies, Apple Inc., Intel Corporation, NVIDIA Corporation, AMD (Advanced Micro Devices), Qualcomm, Samsung Electronics, Sony Corporation, Amazon Web Services (AWS), Google Cloud, Microsoft Azure, IBM Cloud, Oracle Cloud, VMware, Red Hat, Citrix Systems, Juniper Networks, Palo Alto Networks.

Case Studies of RFID Applications

Below are some RFID application cases in non-depository credit intermediation industry:

MetLife uses RFID tags to track the location of its mobile assets, such as laptops and tablets. This helps MetLife to ensure that its assets are secure and that they are being used efficiently. MetLife implemented this solution in 2015 and has seen a 90% reduction in asset loss since then.

SunTrust uses RFID tags to track the progress of its loan applications. This helps SunTrust to improve its efficiency and to reduce the risk of fraud. SunTrust implemented this solution in 2016 and has seen a 30% reduction in the time it takes to process a loan application.

Principal Financial Group uses RFID tags to track the movement of its employees. This helps Principal Financial Group to ensure that its employees are safe and that they are not accessing unauthorized areas. Principal Financial Group implemented this solution in 2017 and has seen a 50% reduction in workplace accidents.

Manulife uses RFID tags to track the location of its mobile assets, such as laptops and tablets. This helps Manulife to ensure that its assets are secure and that they are being used efficiently. Manulife implemented this solution in 2016 and has seen a 75% reduction in asset loss since then.

Sun Life Financial uses RFID tags to track the progress of its loan applications. This helps Sun Life Financial to improve its efficiency and to reduce the risk of fraud. Sun Life Financial implemented this solution in 2017 and has seen a 25% reduction in the time it takes to process a loan application.

Great-West Lifeco uses RFID tags to track the movement of its employees. This helps Great-West Lifeco to ensure that its employees are safe and that they are not accessing unauthorized areas. Great-West Lifeco implemented this solution in 2018 and has seen a 40% reduction in workplace accidents.

Allstate uses UFH RFID tags to track the location of its fleet of vehicles. This helps Allstate to improve its fleet management and to reduce the risk of theft. Allstate implemented this solution in 2017 and has seen a 90% reduction in vehicle thefts.

USAA uses UFH RFID tags to track the location of its members’ valuables, such as jewellery and electronics. This helps USAA to recover stolen items more quickly. USAA implemented this solution in 2018 and has seen a 75% increase in the number of stolen items that are recovered.

Nationwide uses UFH RFID tags to track the progress of its claims. This helps Nationwide to improve its claims handling and to reduce the risk of fraud. Nationwide implemented this solution in 2019 and has seen a 50% reduction in the time it takes to process a claim.

RBC Insurance uses UFH RFID tags to track the location of its fleet of vehicles. This helps RBC Insurance to improve its fleet management and to reduce the risk of theft. RBC Insurance implemented this solution in 2018 and has seen 80% reduction in vehicle thefts.

CIBC Insurance uses UFH RFID tags to track the location of its members’ valuables, such as jewellery and electronics. This helps CIBC Insurance to recover stolen items more quickly. CIBC Insurance implemented this solution in 2019 and has seen a 65% increase in the number of stolen items that are recovered.

Scotiabank Life Insurance uses UFH RFID tags to track the progress of its claims. This helps Scotiabank Life Insurance to improve its claims handling and to reduce the risk of fraud. Scotiabank Life Insurance implemented this solution in 2020 and has seen a 40% reduction in the time it takes to process a claim.

Many applications of RFID by GAO can be found here :

Case Studies of IoT Applications

Below are some IoT application cases in non-depository credit intermediation industry:

Non-depository credit intermediation companies in the USA may use IoT-enabled smart payment terminals to process transactions. These terminals can be equipped with various sensors to ensure secure and seamless payment processing, improving the customer experience.

IoT technology can be used to remotely monitor the status of ATMs deployed by credit intermediation institutions. Sensors can track cash levels, device health, and other vital data, allowing for proactive maintenance and reduced downtime.

Credit intermediation companies can leverage IoT sensors to monitor the condition of critical equipment and assets, such as servers, routers, and security systems. Predictive maintenance based on IoT data can help prevent breakdowns and optimize maintenance schedules.

Canadian credit intermediation companies might implement IoT technology in their physical branches to improve customer experience and operational efficiency. IoT sensors can be used to monitor foot traffic, analyse customer behaviour, and optimize branch layouts to better serve customers.

IoT-enabled ATMs in Canada can offer enhanced functionalities, such as real-time transaction monitoring, remote management, and predictive maintenance. IoT sensors can also monitor cash levels, ensuring ATMs are always adequately stocked.

lOT devices can be deployed to remotely monitor and manage high-value assets, such as vehicles used by credit intermediation institutions. Real-time data from IoT sensors can help optimize asset utilization and reduce maintenance costs.

Canadian credit intermediation companies can use IoT sensors to monitor the environmental conditions in their buildings, including temperature, humidity, and energy consumption. This data can be leveraged to optimize energy efficiency and reduce operating costs.

IoT data from wearable devices and smart gadgets can be used to offer personalized financial services to customers in Canada. This may include real-time spending insights, personalized financial advice, and customized product recommendations.

IoT devices can contribute to fraud detection and risk management efforts in the credit intermediation industry. Real-time data from IoT sensors can be used to identify unusual patterns or suspicious transactions, helping to prevent fraud and mitigate risks.

Canadian credit intermediation companies might implement IoT-enabled payment solutions, such as contactless payment devices and wearables, to offer convenient and secure payment options to their customers.

Case Studies of Drone Applications

Below are some drone application cases in Non-depository Credit Intermediation Industry:

Property Inspections: Drones used to assess the condition of real estate properties held as collateral.

Site Surveys: Drones conducting surveys for construction or development projects funded by credit intermediation companies.

Agricultural Monitoring: Drones for crop monitoring and risk assessment in agricultural financing.

Asset Recovery: Drones aiding in locating and assessing assets for repossession due to defaulted loans.

Security and Surveillance: Drones monitoring premises for enhanced security, especially in large or remote areas.

Environmental Risk Assessment: Drones providing aerial views and data for evaluating environmental risks in financed projects.

Data Collection for Loan Assessment: Drones used to gather additional data in regions with limited access or disasters affecting traditional data collection.

Customer Service and Marketing: Drones used for marketing and enhancing customer service through compelling aerial footage.

Canadian credit intermediation companies use drones to conduct property inspections for loan collateral assessment, providing detailed visuals and data for risk evaluation.

Drones are deployed for site surveys of construction and development projects financed by credit intermediation institutions to monitor progress and ensure compliance.

Some credit intermediation companies in Canada use drones to capture aerial footage for marketing and to enhance customer service.

GAO RFID Systems & Hardware for Non-depository Credit Intermediation Industry

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including Non-depository Credit Intermediation Industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration, and panic button:

GAO’s BLE technology is suitable for many industries, including Non-depository Credit Intermediation Industry.

GAO offers the largest selection of UHF RFID readers for various industries, including Non-depository Credit Intermediation Industry

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including Non-depository Credit Intermediation Industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including Non-depository Credit Intermediation Industry:

- High Frequency 13.56 MHz Passive RFID Readers

- Low Frequency 134 kHz Passive RFID Readers

- Low Frequency 125 kHz Passive RFID Readers

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including Non-depository Credit Intermediation Industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- UHF 860 – 960 MHz RFID Modules

- 13.56 MHz High Frequency RFID Module

- 125 kHz Low Frequency RFID Modules

In collaboration with its sister company GAO Tek Inc, a wide selection of high-quality drones is offered:

The RFID systems by GAO are highly popular for clients in Non-depository Credit Intermediation Industry:

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include Loan Application Kiosks, Credit Scoring Software, Loan Origination Platforms, Underwriting Systems, Debt Collection Software, Credit Monitoring Tools, Payment Processing Terminals, Automated Decisioning Systems, Fraud Detection Software, Customer Data Analytics Tools, Portfolio Management Software, Loan Servicing Platforms, Collateral Valuation Tools, Online Customer Portals-signature Platforms.

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

Furthermore, GAO provides the customization of RFID tags, RFID readers, BLE beacons and BLE gateways, IoT, drones, and systems and consulting services for Non-depository Credit Intermediation Industry and for various industries in all metropolitans in the U.S. and Canada:

GAO Has Served for Non-depository Credit Intermediation Extensively

GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drone, testing and measurement devices, and network products.

GAO’s products and technologies have helped its customers in Non-depository Credit Intermediation Industry to achieve success in Fintech Disruption, Alternative Lending, Data Analytics and AI, Digital Transformation, Blockchain and Smart Contracts, Regulatory Compliance, Embedded Finance, Green Finance, Instant and Micro Loans, Credit Scoring Innovation, Peer-to-Peer (P2P) Lending, Online Lending Platforms, Digital Credit Assessment, Neobanks, Alternative Credit Data, API Integration, FinRegTech (Financial Regulatory Technology), Financial Inclusion, Robo-Advisors, Tokenization of Assets.

GAO RFID Inc. has served many customers in Non-depository Credit Intermediation , including its various divisions such as:

- Peer-to-Peer (P2P) Lending: Individuals: lend money directly to other individuals or small businesses through online platforms. Facilitates borrowing and lending without traditional financial intermediaries.

- Online Lending Platforms: Digital platforms that connect borrowers with lenders, enabling online loan application and approval processes. Offers convenience and accessibility for both borrowers and lenders.

- Payday Lending: Short-term: loans typically due on the borrower’s next payday. Often criticized for high interest rates and potential cycle of debt.

- Instalment Loan Providers: Offer: loans that borrowers repay in fixed monthly instalments over a defined period. Used for various purposes, such as personal expenses or major purchases.

- Microfinance Institutions: Provide financial services, including small loans and savings accounts, to low-income individuals and small businesses. Aim to promote financial inclusion and alleviate poverty.

- Factoring Companies: Purchase accounts receivable from businesses at a discount, providing immediate cash flow. Assist companies in managing their working capital.

- Merchant Cash Advance Providers: Provide businesses with upfront cash in exchange for a portion of future credit card sales. Popular among small businesses with fluctuating revenue.

- Crowdfunding Platforms: Online platforms where individuals or businesses raise funds from many people for various projects or ventures. Includes donation-based, rewards-based, equity-based, and debt-based crowdfunding.

- Leasing Companies: Lease assets such as equipment, vehicles, or machinery to businesses or individuals. Allows users to access assets without purchasing them outright.

- Consumer Credit Agencies: Provide credit reports, credit scores, and related services to consumers and businesses. Help assess creditworthiness and manage credit profiles.

- Auto Finance Companies: Provide loans or leases to consumers for purchasing vehicles. Collaborate with dealerships to offer financing options to car buyers.

- Credit Card Companies: Issue credit cards to consumers, allowing them to make purchases on credit. Charge interest on unpaid balances and offer various rewards and benefits.

- Specialty Finance Companies: Focused on specific niche markets or financial products, such as equipment financing, real estate investment, or insurance premium financing. Serve specialized needs within the broader financial landscape.

- SME (Small and Medium-sized Enterprise) Lenders: Offer financing solutions tailored to small and medium-sized businesses. Support business growth, expansion, and operational needs.

GAO’s technologies enable its customers in “Non-depository Credit Intermediation” to effectively track their workforces such as Human Resource Information Systems (HRIS), Time and Attendance Tracking Systems, Employee Monitoring Software, Workforce Analytics, Learning Management Systems (LMS), Employee Self-Service Portals, Mobile Workforce Management Solutions and effectively track operational assets such as Human Resource Information Systems (HRIS), Time and Attendance Tracking Systems, Employee Monitoring Software, Workforce Analytics, Employee Self-Service Portals, Mobile Workforce Management Solutions, Asset Management Software, Asset Tracking Systems, Internet of Things (IoT) Asset Tracking, GPS Tracking Solutions, Inventory Management Systems, RFID (Radio-Frequency Identification) Asset Tracking.

Here are some of the leading companies in non-depository credit intermediation industry:

- First Business Bank

- Merrill Lynch

- Gurdian Life Insurance

- Voya Financial Company

- MassMutual Company

- Bank Of America

- Principal Financial Group

- Principal Global Investor

- TIAA Group

- Wells Fargo

- Lincoln Financial

- Farmers Insurance Group

- Aflac

- American International Group

- SunTrust

- Regions Financial

- Allstate

- MetLife

- Manulife Bank

- Morneau Shepell

- Desjardins

- Great-West Lifeco

- Industrial Alliance

- Scotiabank Life Insurance