Overview

The Agencies, Brokerages, and Other Insurance Related Activities industry serves as an intermediary between insurance companies and customers. It includes agencies representing specific insurers, brokerages offering a range of options, and ancillary services such as risk assessment and claims processing. This sector facilitates the purchase, sale, and management of insurance products, helping individuals and businesses find appropriate coverage and manage risks effectively.

GAO’s RFID, BLE, IoT, and drone technologies have helped its customers in the agencies, brokerages, and other insurance related activities industry to improve their work processes, their operations and productivity by better management of their staff, materials and operational equipment such as encompasses computers, phones, software tools, printers, and scanners for efficient client communication, policy management, and document processing. Additionally, office furniture, storage systems, high-speed internet, security measures, presentation tools, and office supplies contribute to smooth operations. Photocopiers, billing systems, transportation, and office decor further support the industry’s diverse needs.

Ranked as one of the top 10 global RFID suppliers, GAO RFID Inc. is based in New York City, U.S. and Toronto, Canada. GAO offers a comprehensive selection of UHF, HF (including NFC) and LF RFID (radio frequency identification) readers and tags, BLE (Low Energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), traceability. RFID and BLE products and systems, as well as its IoT and drone technologies, have been successfully deployed for Agencies, Brokerages, and Other Insurance Related Activities industry. Its sister company, GAO Tek Inc. https://gaotek.com, is a leading supplier of industrial or commercial testers and analyzers, drones, and network products.

The targeted markets of both GAO RFID Inc. and GAO Tek Inc. are North America, particularly the U.S., Canada, Mexico, and Europe. As a result, this website gaorfid.com is offered in English and other major languages of North America and Europe such as Spanish, French, German, Italian, Polish, Ukrainian, Romanian, Russian, Dutch, Turkish, Greek, Hungarian, Swedish, Czech, Portuguese, Serbian, Bulgarian, Croatian, Danish, Finnish, Norwegian, Slovak, Catalan, Lithuanian, Bosnian, Galician, Slovene, Latvian, Estonian, Welsh, Icelandic, and Irish.

Applications & Benefits of GAO’s RFID, BLE, IoT & Drones for agencies, brokerages, and other insurance related activities industry

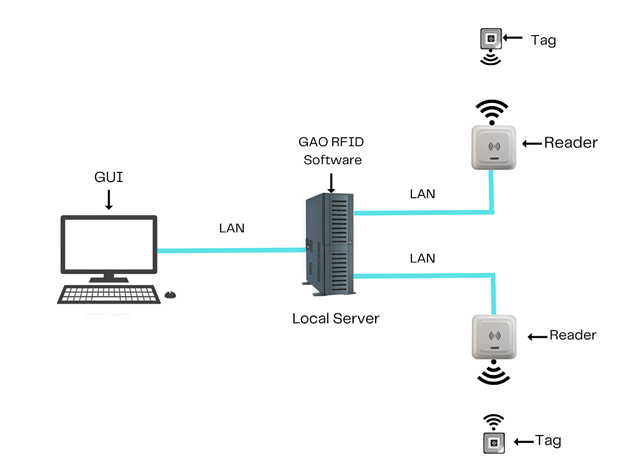

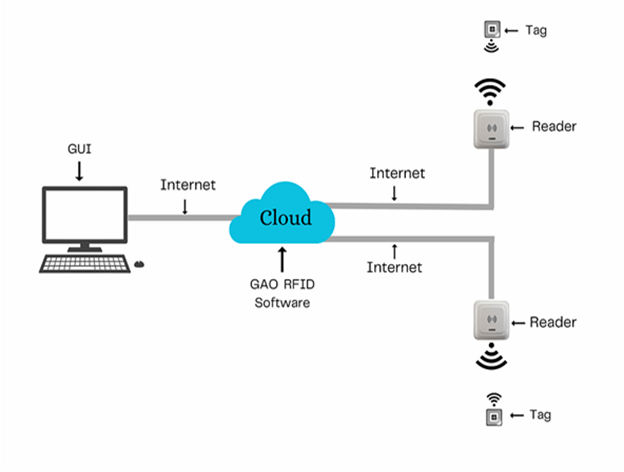

To satisfy its customers, GAO’s RFID or RFID Systems for Agencies, Brokerages, and Other Insurance Related Activities industry were offered in 2 versions. One version is that its software is running on a local server that normally is on our client’s premises, and another version runs in the cloud. The cloud server could be GAO’s cloud server, client’s own cloud server or a cloud server from one of the leading cloud server providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud (formerly SoftLayer), Oracle Cloud, RedHat, Heroku, Digital Ocean, CloudFlare, Linode and Rackspace. The above illustrates GAO system for agencies, brokerages, and other insurance related activities industry with its software running on a local server.

The above illustrates GAO system for agencies, brokerages, and other insurance related activities industry with its software running in cloud.

GAO’s RFID and BLE technologies, consisting of RFID readers, RFID tags, BLE gateways, BLE beacons, software, cloud services and their systems, have the following applications in agencies, brokerages, and other insurance related activities industry:

- Inventory Management: Utilizing GAO’s RFID tags can track and manage physical assets, such as office equipment, furniture, and IT devices, streamlining inventory management and reducing loss or theft.

- Document Tracking: Our RFID can be integrated into document management systems, allowing easy tracking and locating of important client records, policies, and contracts, improving organization and retrieval.

- Access Control: Utilizing GAO’s RFID-enabled access cards or badges enhance security by regulating entry to office premises, ensuring only authorized personnel can enter restricted areas.

- Asset Tracking for Claim Adjustments: In cases of insurance claims involving damaged or stolen property, Our RFID technology aids in tracking and verifying the status and location of insured assets, expediting claim processing.

- Inventory Verification for Insurance Coverage: Brokers and agents can use RFID to validate the existence and condition of insured items, minimizing fraudulent claims and ensuring accurate coverage.

- Loss Prevention in Inventory Claims: For insurance policies covering inventory losses, RFID helps monitor stock levels, detect discrepancies, and prevent fraudulent claims.

- Automated Asset Valuation: RFID-enabled asset tracking assists in determining the value of insured assets accurately during underwriting and claim settlement processes.

- Vehicle and Asset Tracking: In auto insurance, RFID-equipped devices can monitor driver behavior, vehicle usage, and location, contributing to personalized policies and accurate claims assessment.

- Claims Processing: RFID tags can be used to label damaged property or items to streamline the claims inspection process, enabling faster assessments and payouts.

- Customer Interaction: RFID-enabled loyalty cards or client identifiers can enhance customer engagement by offering personalized discounts, promotions, and tailored insurance options.

- Fraud Detection: RFID helps mitigate fraud by tracking the movement and authenticity of high-value items insured, reducing instances of false claims.

- Asset Verification in Reinsurance: For reinsurance purposes, RFID assists in verifying the existence and condition of insured assets held by the primary insurance companies.

- Event Management: RFID wristbands or badges can be used for streamlined event registration and access control in insurance-related seminars, workshops, and conferences.

- Emergency Response: RFID can aid in identifying insured individuals during emergency situations, facilitating efficient communication and support during critical times.

- Secure Document Transfer: RFID can ensure secure and encrypted document transfers between parties, maintaining confidentiality in sensitive insurance transactions.

GAO’s drone technologies find the following applications in the agencies, brokerages, and other insurance related activities industry:

- Property Inspections: Utilizing GAO’s Drones can perform aerial inspections of properties, providing insurers and underwriters with visual data for risk assessment and accurate property valuation.

- Claims Assessment: After natural disasters or accidents, our drones can quickly survey and assess damages, aiding adjusters in estimating claim payouts and expediting the claims process.

- Risk Management: GAO’s Drones assist in assessing potential risks by capturing detailed imagery of properties and locations, helping insurers make informed decisions regarding coverage.

- Catastrophe Response: In the event of disasters like hurricanes or wildfires, our drones can rapidly survey affected areas, providing real-time information to insurers for prompt response and support.

- Roof Inspections: Utilizing GAO’s Drones can inspect roofs for damage, wear, and tear, ensuring accurate assessments for property insurance coverage and claims.

- Underwriting Surveys: Our Drones capture high-resolution images and data, facilitating accurate underwriting assessments for property and casualty insurance.

- Site Surveys: Drones are useful for site inspections during the underwriting process, offering detailed views of construction sites, industrial facilities, and more.

- Loss Prevention: Drones help monitor and patrol high-risk areas, such as construction sites, to prevent potential losses or damage.

- Fraud Prevention: Aerial imagery from drones can help detect fraudulent claims by providing accurate visual evidence of pre-existing damages.

- Customer Engagement: Insurance agencies can use drones to create engaging promotional content, such as property showcase videos for real estate insurance.

- Surveying Remote Locations: Our Drones can access and survey remote or hazardous areas that are challenging for humans to reach, aiding in risk assessment and claims evaluation.

- Environmental Assessments: Drones can assess environmental damage caused by events like oil spills, aiding in pollution liability claims.

- Reinsurance Inspections: For reinsurance purposes, our drones provide reliable and up-to-date visual data on insured assets held by primary insurance companies.

- Emergency Response: Utilizing GAO’s Drones can assist in locating and providing support to insured individuals during emergencies or disasters.

- Customer Education: Utilizing GAO’s Drones can be used to create educational content about insurance-related topics, enhancing customer understanding of coverage and risk

GAO’s IoT technologies, consisting of IoT sensors, sensors networks and systems, find the following applications in the agencies, brokerages, and other insurance related activities industry:

- Telematics for Auto Insurance: Utilizing GAO’s IoT devices in vehicles collect data on driving behavior, enabling usage-based insurance pricing and promoting safer driving habits.

- Property Monitoring: Smart sensors and devices in properties provide real-time data on conditions like temperature, humidity, and security, helping assess risks and adjust coverage accordingly.

- Asset Tracking: GAO’s IoT-enabled trackers help monitor the location and condition of insured assets, preventing losses and streamlining claims processing.

- Health and Wellness Monitoring: Wearable devices and health trackers provide insurers with data on policyholders’ health habits, potentially leading to personalized health insurance offerings.

- Predictive Maintenance: GAO’s IoT sensors on insured equipment can predict maintenance needs, minimizing downtime and reducing insurance claims for equipment failure.

- Environmental Monitoring: GAO’s IoT devices can track environmental factors that affect insured properties, assisting in risk assessment and claims evaluations.

- Safety and Security: GAO’s IoT-enabled security systems and alarms enhance property protection, reducing risks and potential claims.

- Smart Home Integration: Integration with our smart home devices allows insurers to offer discounts for customers with enhanced security systems and energy-efficient technology.

- Risk Assessment: GAO’s IoT-generated data aids in assessing potential risks and determining accurate insurance premiums.

- Claims Verification: Our IoT data can validate the authenticity of claims by providing real-time information about events leading to losses.

- Emergency Response: Our IoT devices can trigger emergency alerts and facilitate communication during critical incidents, expediting response times.

- Data-Driven Underwriting: Our IoT-generated data provides insights into customer behavior, enabling more accurate underwriting decisions.

- Customer Engagement: Our IoT-connected devices create opportunities for insurers to engage with customers through personalized offers and recommendations.

- Environmental Impact Assessment: IoT data helps assess environmental damages and pollution levels, affecting policies related to environmental liability.

- Remote Inspections: IoT devices enable remote inspections of insured locations, improving efficiency and reducing costs.

- Supply Chain Monitoring: Our IoT devices can monitor the status and location of goods in transit, affecting cargo insurance and claims processing.

- Equipment Lease Monitoring: For leased assets, IoT sensors track usage patterns and conditions, ensuring compliance with insurance terms.

- Insurance-Linked IoT Devices: Insurers we can offer IoT devices as part of insurance packages, such as smoke detectors for home insurance.

- Energy Usage Tracking: IoT technology helps monitor energy consumption in insured properties, potentially leading to energy-saving incentives.

GAO Helps Customers Comply with Standards, Mandates & Regulations of Agencies, Brokerages, and Other Insurance Related Activities industry

GAO RFID Inc. has helped many companies in Agencies, Brokerages, and Other Insurance Related Activities industry to deploy RFID, BLE, IoT and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- Asset Tracking with BLE

- Location-Based Services

- Proximity Marketing

- Customer Engagement through BLE

- BLE for Safety and Security

- BLE Integration in IoT

- Data Collection with BLE

- ISO/IEC 30141

- ISO/IEC 27000 Series

- ISO/IEC 20924

- OneM2M

- OMA Lightweight M2M (LwM2M)

- FIDO Alliance Standards

- Thread

- Open Connectivity Foundation (OCF)

- LoRaWAN

- Smart Contracts (Blockchain Standards)

- ISO 21384-3

- ASTM F3411

- ISO 23629

- ANSI/ASME PTC 46

- ISO 17789

- ISO 17787

- ASTM F3266

- ANSI/UL 3030

- JARUS SORA Guidelines

- FAA Part 107 (U.S.)

- ICAO Circular 328

- EASA Common Rules for Drones (EU)

Government Regulations

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- Gramm-Leach-Bliley Act

- Fair Credit Reporting Act (FCRA)

- Health Insurance Portability and Accountability Act (HIPAA)

- Terrorism Risk Insurance Act (TRIA)

- National Flood Insurance Program (NFIP)

- Affordable Care Act (ACA)

- Securities Exchange Act of 1934

- Federal Insurance Contributions Act (FICA)

- Anti-Money Laundering (AML) Regulations

Canadian Government Regulations

- Financial Consumer Agency of Canada Act

- Insurance Companies Act

- Canadian Council of Insurance Regulators (CCIR) Guidelines

- Office of the Superintendent of Financial Institutions (OSFI) Regulations

- Personal Information Protection and Electronic Documents Act (PIPEDA)

- Anti-Money Laundering and Anti-Terrorist Financing Regulations (AMLATF)

- Quebec Act respecting the distribution of financial products and services

- Alberta Insurance Act

- British Columbia Financial Institutions Act

- Saskatchewan Insurance Act

- Manitoba Insurance Act

- Ontario Insurance Act

- New Brunswick Insurance Act

- Nova Scotia Insurance Act

- Prince Edward Island Insurance Act

- Newfoundland and Labrador Insurance Companies Act

- Northwest Territories Insurance Act

- Yukon Insurance Act

- Nunavut Insurance Act

GAO Software Provides Easy Integration with API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in agencies, brokerages, and other insurance related activities industry such as

Personnel Management:

- Employee Onboarding and Offboarding

- Performance Appraisals and Reviews

- Payroll and Compensation Management

- Training and Development Tracking

- HR Compliance and Documentation

- Time and Attendance Management

- Succession Planning

Equipment Management:

- Tracking IT Devices and Assets

- Maintenance Scheduling for Office Equipment

- Inventory Management of Office Supplies

- Document Scanning and Storage

- Equipment Lease Management

Access Control:

- Office Premises Security and Surveillance

- Visitor Management and Entry Control

- Secure Access to Sensitive Data and Systems

- Identity and Authentication Management

Warehouse Management:

- Storage and Retrieval of Physical Documents

- Inventory Tracking of Marketing Materials

- Equipment Storage and Maintenance

- Archiving and Record Keeping

Supply Chain Management:

- Managing Relationships with Insurance Providers

- Tracking and Managing Insurance Policies

- Claims Processing and Management

- Vendor and Partner Management

- Regulatory Compliance Tracking

Other Applications:

- Customer Relationship Management (CRM)

- Policyholder Communication and Engagement

- Risk Assessment and Analysis

- Data Analytics for Underwriting and Claims Assessment

- Fraud Detection and Prevention

- Document Management for Contracts and Agreements

- Reporting and Analytics for Business Insights

GAO has enabled its customers to make use of some of the leading software and cloud services in Agencies, Brokerages, and Other Insurance Related Activities industry. Below are some of popular software and cloud services in agencies, brokerages, and other insurance related activities industry.

In the agencies, brokerages, and other insurance related activities industry, leading commercial software includes SAP SuccessFactors, Workday, Oracle HCM Cloud, BambooHR, ADP Workforce Now, and Paycom. For equipment management, solutions like Asset Panda, UpKeep, EZOfficeInventory, Fiix, Hippo CMMS, and eMaint CMMS are prominent choices. These software options aid in optimizing workforce management and effectively tracking equipment within the industry.

GAO has worked with some of the leading technology companies in agencies, brokerages, and other insurance related activities industry to provide integrated its RFID, BLE, IoT and drone solutions to customers. Here are some of the technology leaders in agencies, brokerages, and other insurance related activities industry Prominent information technology companies catering to the Agencies, Brokerages, and Other Insurance Related Activities industry include Applied Systems, Vertafore, Insurity, Duck Creek Technologies, Guidewire Software, Ebix, Sapiens, AgencyBloc, Instanda, and InsFocus. These companies offer tailored software and technology solutions to streamline operations and enhance efficiency within the insurance sector, DocuSign, HelloSign, Adobe Sign, AssureSign, InsureSign, SignNow, PandaDoc, eOriginal, OneSpan, and NitroSign. These companies offer electronic signature and document management solutions to streamline transactions, enhance document security, and improve operational efficiency within the insurance sector.

Case Studies of RFID Applications

Below are some RFID application cases in agencies, brokerages, and other insurance related activities industry:

- Inventory Management at Insurance Agencies RFID technology could be used to track office supplies, marketing materials, and equipment, enhancing efficiency and reducing overhead costs.

- Document Tracking and Management RFID tags could be integrated into physical documents, making it easier to locate and manage important contracts, policies, and claims records.

- Access Control and Security RFID-enabled access cards could be used to regulate entry to secure areas within insurance agencies or brokerages, enhancing premises security.

- Asset Verification for Insurance Policies RFID tags could be placed on insured assets, allowing for accurate and efficient verification during underwriting and claims assessment.

- Risk Assessment for Property Insurance RFID technology could assist in conducting thorough risk assessments by providing real-time data on the condition of insured properties.

- Claims Processing and Verification RFID-enabled tags could be attached to damaged items, facilitating the claims process by providing accurate and timely information.

- Supply Chain Management for Insurance Policies RFID could be used to track the movement of insurance policies throughout the distribution chain, ensuring proper delivery and minimizing errors.

- Customer Interaction and Engagement RFID technology could enable interactive marketing campaigns, offering personalized insurance options or discounts based on customer preferences.

- Emergency Response and Asset Tracking RFID tags could help locate and account for insured assets during emergency situations, expediting claims processing.

- Inventory Management for Insurance Supplies RFID technology could streamline the tracking of office supplies, promotional materials, and equipment used by insurance agencies and brokerages.

- Document Tracking and Compliance: RFID-enabled document management systems could aid in tracking important contracts, compliance documents, and client records efficiently.

- Access Control and Premises Security RFID-based access control systems could enhance security measures by managing entry to restricted areas within insurance offices.

- Asset Verification in Underwriting: RFID tags could be used to verify the existence and condition of assets during underwriting assessments for insurance policies.

- Claims Processing and Asset Validation RFID technology could facilitate efficient claims processing by validating the status and authenticity of damaged or lost assets.

- Risk Assessment for Property Insurance RFID-enabled data collection could provide real-time insights into the condition of insured properties, aiding in risk assessment.

- Supply Chain Management for Policies RFID tags could help track the movement of physical insurance policies from production to distribution, ensuring accurate delivery.

- Customer Engagement and Loyalty Programs RFID-based loyalty cards or engagement programs could offer personalized insurance options and benefits to clients.

- Emergency Response and Asset Tracking RFID-enabled assets could be easily located during emergencies, expediting the claims and recovery process.

Many applications of RFID by GAO can be found here:

Case Studies of IoT Applications

Below are some IoT application cases in agencies, brokerages, and other insurance related activities industry:

- Telematics for Auto Insurance IoT devices installed in vehicles could gather driving behavior data, enabling usage-based insurance pricing and personalized policies.

- Property Monitoring and Risk Assessment IoT sensors could provide real-time data on the condition of insured properties, aiding in risk assessment for property insurance.

- Claims Assessment and Verification IoT sensors could be used to validate the authenticity of claims by providing real-time information about damages or incidents.

- Health and Wellness Monitoring for Health Insurance IoT wearables could collect health data to determine personalized health insurance plans and premiums.

- Supply Chain Tracking for Insurance Policies IoT-enabled devices could track the movement of insurance policies through the distribution chain, ensuring accurate delivery.

- Emergency Response and Asset Tracking IoT sensors could help locate and monitor insured assets during emergencies, expediting claims processing.

- Equipment Maintenance for Insurance Agencies IoT devices could monitor the condition of office equipment, ensuring proper maintenance and minimizing downtime.

- Smart Home Integration for Property Insurance IoT devices within insured homes could provide real-time data on security and safety measures, affecting policy premiums.

- Risk Mitigation for Commercial Insurance IoT sensors could monitor industrial equipment, helping prevent losses and mitigate risks for commercial insurance.

- Environmental Monitoring for Liability Insurance IoT devices could track environmental conditions to assess pollution and damage for environmental liability insurance.

- Telematics for Auto Insurance IoT devices in vehicles could gather driving behavior data, allowing insurers to offer usage-based insurance policies.

- Property Monitoring and Risk Assessment IoT sensors could provide real-time property data, aiding insurers in assessing risks for property insurance.

- Claims Verification and Processing IoT sensors could validate claims by providing real-time information about incidents and damages.

- Health and Wellness Tracking for Insurance IoT wearables could track health data to tailor insurance plans and offer discounts.

- Supply Chain Management for Policy Distribution: IoT-enabled devices could monitor the movement of insurance policies, ensuring accurate delivery.

- Emergency Response and Asset Tracking IoT sensors could assist in locating and managing insured assets during emergencies.

- Equipment Maintenance for Insurance Agencies IoT devices could monitor office equipment, ensuring proper maintenance and reducing downtime.

- Smart Home Integration for Property Insurance IoT devices in homes could provide data on security and safety for more accurate policy pricing.

- Risk Mitigation for Commercial Insurance IoT sensors could monitor equipment and assets to prevent losses and mitigate risks.

- Environmental Monitoring for Liability Insurance IoT devices could assess environmental conditions and potential damage for liability insurance

Case Studies of Drone Applications

Below are some drone application cases in agencies, brokerages, and other insurance related activities industry:

- Drones could be used to assess property conditions before underwriting, ensuring accurate coverage and risk assessment.

- Drones could survey damage after accidents or natural disasters, expediting claims processing and reducing fraud.

- Drones could help assess risks by capturing detailed imagery of properties, enhancing underwriting decisions.

- Drones could provide real-time data on affected areas during disasters, enabling faster response and support.

- Drones could inspect roofs for damage, aiding in property insurance assessments.

- Drones could capture views of construction sites and industrial facilities for accurate underwriting assessments.

- Drones could patrol high-risk areas like construction sites to prevent losses or damages.

- Drones could provide visual evidence to detect fraudulent claims by documenting pre-existing damages.

- Drones could create engaging promotional content, such as property showcase videos for real estate insurance.

- Drones could assess environmental damages, aiding pollution liability claims.

- Drones can be used to assess property damage caused by natural disasters, accidents, or other incidents. They provide quick and accurate visual data that helps insurance agencies determine the extent of the damage and expedite claims processing.

- Drones equipped with specialized sensors can collect data about properties’ conditions, enabling insurance companies to assess risks accurately for property and casualty insurance.

- In agricultural regions, drones equipped with multispectral cameras can monitor crop health and assess potential damage due to factors like weather, pests, or diseases. This data can inform crop insurance policies.

- Drones can provide detailed imagery of accident or disaster scenes, assisting claims adjusters in conducting investigations and assessing the validity of claims.

- Drones can access difficult-to-reach locations such as rooftops or remote areas, reducing the need for human inspectors to travel to these places.

- Drones can be deployed quickly in the aftermath of a catastrophe to assess damage in hazardous or inaccessible areas, helping insurers respond promptly to policyholders’ needs.

- Drones can help detect potential insurance fraud by capturing accurate visual evidence of the claimed damages or incidents.

- In the case of industrial or commercial insurance, drones can perform safety inspections of structures, pipelines, and equipment, identifying potential risks and hazards.

- Drones can be used to monitor and assess environmental risks, such as pollution or damage to natural resources, which can impact insurance policies.

- Drones can provide real-time visual data to verify the accuracy of claims made by policyholders, reducing disputes and improving the claims process.

- Drones can capture aerial footage of accidents or incidents involving public spaces, helping to assess liability claims.

GAO RFID Systems & Hardware for agencies, brokerages, and other insurance related activities implemented industry.

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including agencies, brokerages, and other insurance related activities implemented industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration and panic button:

GAO’s BLE technology is suitable for many industries, including agencies, brokerages, and other insurance related activities implemented industry.

UHF (Ultra High Frequency) RFID

GAO offers the largest selection of UHF RFID readers for various industries, including agencies, brokerages, and other insurance related activities implemented industry:

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including agencies, brokerages, and other insurance related activities implemented industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including agencies, brokerages, and other insurance related activities implemented industry:

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including Agencies, Brokerages, and Other Insurance Related Activities implemented industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- Find Your 860-960 MHz RFID Module

- Find Your 13.56 MHz High Frequency RFID Module

- Find Your 125 kHz RFID Reader Modules

In collaboration with its sister company GAO Tek Inc, a wide selection of high quality drones are offered:

The RFID systems by GAO are highly popular for client’s agencies, brokerages, and other insurance related activities implemented industry

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include enhance their operations. These include essential tools like Customer Relationship Management (CRM) software for managing client data, computers and smartphones for communication and data access, document scanners for digitizing paperwork, and digital cameras for visual documentation of incidents. Drones equipped with cameras and sensors aid in property inspections and risk assessment, while laser measurement tools ensure accurate property measurements. Telematics devices collect driving behavior data for auto insurance, and weather monitoring tools assess risks related to weather events. Multispectral cameras are useful in agriculture insurance for crop health assessment, and virtual reality (VR) tools offer virtual property tours. Geographic Information System (GIS) software analyzes spatial data for risk assessment, and video conferencing equipment facilitates remote client meetings. Claims software streamlines claims processing, electronic signature platforms reduce paperwork, and security cameras ensure premises safety. Data analytics tools inform decisions, biometric identification systems enhance security, and portable printers, scanners, and power banks aid in on-site tasks.

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

Furthermore, GAO provides the customization of RFID tags, RFID readers, BLE beacons and BLE gateways, IoT, drones, and systems and consulting services for Agencies, Brokerages, and Other Insurance Related Activities implemented and for various industries in all metropolitans in the U.S. and Canada:

GAO Has Served agencies, brokerages, and other insurance related activities implemented industry Extensively

GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drone, testing and measurement devices, and network products.

GAO’s products and technologies have helped its customers in agencies, brokerages, and other insurance related activities implemented industry to achieve success in the insurance industry, encompassing agencies, brokerages, and related activities, has witnessed significant transformation driven by key trends and concepts. Insurtech, digital transformation, and data analytics with big data have reshaped operations and customer engagement. Artificial Intelligence (AI) and blockchain are revolutionizing processes, enhancing security, and enabling innovation. A customer-centric approach drives personalized services, while usage-based insurance (UBI) and microinsurance cater to specific needs. Partnerships within ecosystems and the integration of chatbots and virtual assistants improve accessibility and service quality. Cyber insurance addresses evolving digital risks, while on-demand and climate risk management policies adapt to changing demands. Regulatory technology (RegTech) streamlines compliance, and parametric insurance simplifies claims. Diversity and inclusion are paramount, customer journey mapping refines experiences, and digital claims processing expedites settlements. Predictive underwriting leverages data for accurate risk assessment, reflecting an industry shaped by these dynamic trends.

GAO RFID Inc. has deployed RFID, BLE and IoT projects for many companies in agencies, brokerages, and other insurance related activities implemented industry including, many in its various divisions such as

- Property and Casualty Insurance: Provides coverage for properties and assets against damage, theft, liability, and other risks.

- Life Insurance: Offers coverage for individuals’ lives, providing financial protection for beneficiaries in case of the insured person’s death.

- Health Insurance: Focuses on covering medical expenses and healthcare-related costs for individuals or groups.

- Auto Insurance: Specializes in coverage for vehicles against damage, accidents, and liability arising from vehicle-related incidents.

- Commercial Insurance: Provides coverage for businesses and organizations against various risks such as property damage, liability, and employee-related issues.

- Reinsurance: Involves insurance companies transferring a portion of their risks to other insurers in order to manage their exposure.

- Catastrophe Insurance: Focuses on providing coverage for extreme events such as natural disasters, ensuring financial protection against large-scale losses.

- Travel Insurance: Offers coverage for travelers against risks like trip cancellations, medical emergencies, and lost baggage.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it covers professionals against claims of negligence or inadequate work.

- Surety Bonds: Guarantees that certain obligations will be fulfilled, often required in construction and contractual agreements.

- Marine Insurance: Covers ships, cargo, and other marine-related risks, including those related to shipping and logistics.

- Aviation Insurance: Provides coverage for aircraft, airlines, and aviation-related risks such as accidents and liability.

- Crop Insurance: Offers coverage for farmers against losses due to crop damage caused by various factors like weather, pests, and disease.

- Pet Insurance: Covers veterinary expenses and medical care for pets.

- Title Insurance: Protects property owners and lenders against defects in property titles.

- Trade Credit Insurance: Provides coverage to businesses against losses due to non-payment by customers.

- Environmental Insurance: Focuses on coverage for environmental liabilities, pollution-related risks, and cleanup costs.

- Political Risk Insurance: Offers coverage for businesses against risks related to political instability and governmental actions in foreign markets.

- Kidnap and Ransom Insurance: Covers individuals and companies against kidnapping, extortion, and ransom demands.

- Entertainment Insurance: Provides coverage for risks related to the entertainment industry, including film production, events, and performances.

GAO’s technologies enable its customers in “Agencies, Brokerages, and Other Insurance Related Activities implemented industry” to effectively track their workforces such as a diverse spectrum of roles contribute to the industry’s functionality. These encompass Insurance Agents, Underwriters who assess risks, Claims Adjusters handling claims, and Customer Service Representatives maintaining client interactions. Insurance Brokers facilitate connections, while Actuaries analyze risk statistics. Assistants aid Underwriters, Loss Control Specialists advise on risk prevention, and Claims Processors manage claim intricacies. Marketing Specialists promote products, Policy Administrators manage records, and Risk Managers identify and mitigate risks. Insurance Auditors review premium accuracy, Premium Analysts calculate rates, and Compliance Officers ensure adherence to regulations. Investigative Claims Specialists validate claims, Operations Managers oversee workflows, and Loss Prevention Specialists enhance risk awareness. Technology Specialists manage systems, and Claims Negotiators engage in settlement discussions. These roles collectively shape the industry’s operations and client services and effectively track operational assets such as includes computers and laptops for data management, communication via phones and VoIP systems, and document handling with printers and scanners. Multi-function devices streamline tasks, while software like CRM systems and document management tools optimize workflows. Office supplies, calculators, and accounting software assist in administrative and financial tasks, and presentation tools like whiteboards and projectors aid in communication. Security equipment, network devices, and backup systems ensure data protection and continuity. Mobile devices, desk phones, and headsets enable flexible communication. Cloud services and security software provide digital solutions, while ergonomic accessories enhance workplace comfort. This equipment collectively empowers the smooth functioning of insurance-related operations.

Here are some of the leading companies in agencies, brokerages, and other insurance-related activities industry:

- Aon

- Marsh & McLennan

- Brown & Brown

- Hub International

- Arthur J. Gallagher & Co.

- USI Insurance Services

- The Hartford

- Willis Towers Watson

- NFP

- Risk Strategies

- AmWINS Group

- Bollinger Insurance

- Cross Insurance

- HUB International New England

- EPIC Insurance Brokers & Consultants

- M3 Insurance

- TCOR Insurance Management

- World Insurance Associates

- Gowrie Group

- Assured Partners

- Marsh Canada

- Aon Canada

- Hub International

- Arthur J. Gallagher Canada

- HUB International Canada

- Intact Financial Corporation

- Desjardins Insurance

- The Co-operators

- Aviva Canada

- TD Insurance

- Sun Life Financial

- Manulife Financial

- RSA Canada

- Allstate Canada

- Cowan Insurance Group

- Johnson Insurance

- Western Financial Group

- Wawanesa Insurance

- Economical Insurance

- Northbridge Financial Corporation

You Are Invited to Contact Us!

If you are interested in our products, services or partnering with us, please feel free to contact us by filling out this form:

or email us at sales@gaorfid.com