Overview

In the context of the credit intermediation and related activities industry, Radio-Frequency Identification (RFID) technology enables the seamless tracking and management of assets, such as loan documents and collateral, enhancing operational efficiency and reducing errors. Bluetooth Low Energy (BLE) technology facilitates secure and low-power communication between devices, supporting personalized customer interactions within branches and enabling convenient mobile payment solutions. The Internet of Things (IoT) integration empowers real-time monitoring of credit transactions and risk assessment, optimizing decision-making processes. Drones play a role in property assessment and surveillance for accurate valuation and risk evaluation of potential collateral, contributing to informed lending practices in the industry.

GAO’s RFID, BLE, IoT, and drone technologies have helped its customers in credit intermediation and related activities industry to improve their work processes, their operations and productivity by better management of their staff, materials and operational equipment such as effectively operate and provide financial services. This includes essential tools such as computers and servers for data management and processing, as well as secure networking equipment to ensure the confidentiality of sensitive information. Communication systems like phones and video conferencing facilities enable seamless interactions with clients and partners. Financial institutions also require advanced software for customer relationship management, loan origination, credit analysis, and risk assessment. Additionally, physical branch locations demand furniture, security systems, and point-of-sale terminals for customer transactions. For on-site assessments, drones and cameras aid in property valuation and collateral evaluation. Moreover, RFID and BLE technology play a role in asset tracking and personalized customer experiences. Overall, this industry relies on a comprehensive mix of technology, communication, security, and assessment equipment to effectively carry out its intermediation and related activities.

Ranked as one of the top 10 global RFID suppliers, GAO RFID Inc. is based in New York City, U.S. and Toronto, Canada. GAO offers a comprehensive selection of UHF, HF (including NFC) and LF RFID (radio frequency identification) readers and tags, BLE (Low Energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), traceability. Such RFID and BLE products and systems, as well as its IoT and drone technologies, have been successfully deployed for credit intermediation and related activities industry. Its sister company, GAO Tek Inc. https://gaotek.com, is a leading supplier of industrial or commercial testers and analyzers,drones, and network products.

Applications & Benefits of GAO’s RFID, BLE, IoT&Drones for Credit Intermediation and Related Activities Industry

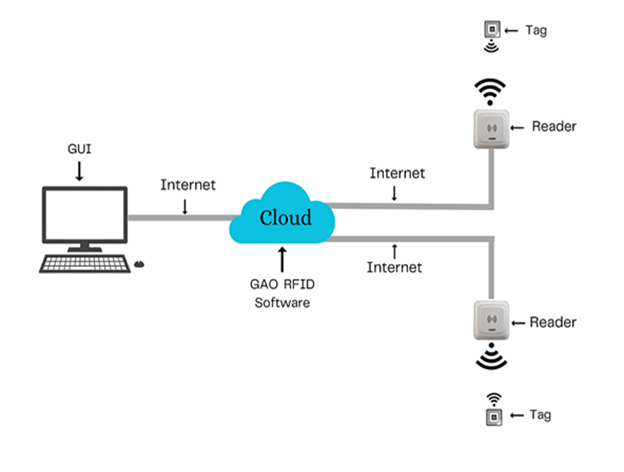

To satisfy its customers, GAO’s RFID or RFID Systems for credit intermediation and related activities industry are offered in 2 versions. One version is that its software is running on a local server that normally is on our client’s premise, and another version runs in the cloud. The cloud server could be GAO’s cloud server, client’s own cloud server or a cloud server from one of the leading cloud server providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud (formerly SoftLayer), Oracle Cloud, RedHat, Heroku, Digital Ocean, CloudFlare, Linode and Rackspace. The above illustrates GAO system for credit intermediation and related activities industry with its software running on a local server.

The above illustrates the GAO system credit intermediation and related activities industry with its software running in the cloud.

GAO’s RFID and BLE technologies, consisting of RFID readers, RFID tags, BLE gateways, BLE beacons, software, cloud services and their systems, have the following applications in credit intermediation and related activities industry:

- Asset Tracking: RFID tags can be attached to important assets such as loan documents, contracts, and collateral items. This enables easy and accurate tracking of these assets throughout their lifecycle, reducing the risk of loss or misplacement.

- Document Management: RFID can streamline document management by allowing quick retrieval and organization of critical paperwork. This enhances operational efficiency and reduces the time spent searching for important documents.

- Inventory Management: Financial institutions can use RFID to manage inventory of items like office supplies, promotional materials, and physical assets. This optimizes resource allocation and reduces unnecessary expenditures.

- Access Control: RFID-enabled access cards or badges enhance security by controlling entry to sensitive areas, such as data centers or confidential document storage rooms.

- Customer Interaction: RFID technology can be integrated into customer loyalty cards or membership programs, enabling personalized interactions and targeted marketing efforts.

- Loan File Tracking: RFID tags attached to loan files can streamline the loan approval process by ensuring that all required documents are present and in order, reducing processing time and improving customer experience.

- Anti-Fraud Measures: RFID tags with encryption can be integrated into credit cards to enhance security and protect against counterfeiting and unauthorized use.

- Remote Asset Verification: RFID-equipped drones can be utilized to remotely verify the existence and condition of collateral assets, reducing the need for manual inspections.

- Transaction Verification: RFID tags on physical checks or financial instruments can help verify the authenticity of transactions and reduce the risk of fraud.

- Data Entry and Accuracy: RFID technology can be used to automatically populate forms and databases, minimizing manual data entry errors and ensuring accuracy.

- Mobile Payment: RFID-enabled mobile payment solutions can offer convenient and secure payment options for customers.

- Customer Identification: RFID badges or cards can help identify customers in branches or at events, streamlining interactions and providing a more personalized experience.

GAO’s drone technologies find the following applications in credit intermediation and related activities industry:

- Property Appraisal and Assessment: Drones can be used to assess the condition and value of properties that are put up as collateral for loans. They can capture high-resolution images and videos of properties, providing lenders with up-to-date information for more accurate valuations.

- Risk Assessment: Drones can survey and gather data on properties, infrastructure, and collateral in remote or hard-to-reach areas. This information can help lenders assess the risk associated with lending to certain individuals or businesses.

- Monitoring Collateral: Drones can be used to monitor properties and assets that are part of a lending agreement. This can help lenders ensure that collateral remains in good condition and isn’t subject to damage or depreciation.

- Debt Recovery: In case of loan defaults, drones could assist in the recovery process by providing real-time visual information about the condition of the property or asset, aiding lenders in making informed decisions about recovery actions.

- Geographical Data Analysis: Drones can capture geospatial data that can be used in credit risk analysis. For instance, they can survey the environment around a property, helping lenders understand potential environmental risks that might affect the value of the collateral.

- Remote Customer Verification: Drones could be used to verify the identity and location of loan applicants in remote areas. This might be particularly relevant for microfinance institutions operating in underserved regions.

- Disaster Assessment for Insurance Purposes: While more related to insurance, in case of natural disasters, drones could be used to assess the extent of damage to properties, allowing lenders to make informed decisions regarding loan repayment timelines.

- Security and Fraud Prevention: Drones equipped with cameras and sensors can help financial institutions monitor and secure their physical premises, thereby reducing the risk of fraud or theft.

- Data Collection for Credit Scoring: Drones could capture data about businesses’ operations or individuals’ activities that could be used to refine credit scoring models.

- Enhanced Customer Service: Drones might be utilized in providing personalized customer service to high-value clients, such as delivering documents or facilitating remote meetings.

GAO’s IoT technologies, consisting of IoT sensors, sensors networks and systems, find the following applications in the credit intermediation and related activities industry:

- Smart Asset Monitoring: IoT devices can be attached to collateral or valuable assets to monitor their condition and location in real-time. Lenders can receive alerts if assets are moved or if there are significant changes in their status, helping to mitigate risks associated with loans.

- Risk Assessment: IoT sensors can gather data from various sources to assess the risk associated with lending to certain individuals or businesses. For example, sensors on manufacturing equipment could provide insights into the health and efficiency of a business, influencing lending decisions.

- Credit Scoring and Analysis: IoT-generated data can provide more accurate and real-time insights into a borrower’s financial behavior. For instance, data from smart appliances or connected cars could contribute to a more comprehensive credit scoring model.

- Supply Chain Finance: IoT devices can track the movement of goods within a supply chain. Lenders could use this data to assess the stability and performance of businesses involved in the supply chain, potentially offering financing based on this information.

- Fraud Prevention: IoT devices can enhance security measures. For instance, biometric sensors and smart cameras can be used to verify the identity of borrowers, reducing the risk of fraud.

- Automated Payment Monitoring: IoT can facilitate automated monitoring of borrowers’ payment activities. Connected devices can generate alerts for missed payments or unusual transaction patterns, enabling prompt actions by lenders.

- Real-time Data for Underwriting: IoT devices can provide real-time data on various aspects of a borrower’s business or personal life, enabling more accurate and up-to-date underwriting decisions.

- Customer Engagement and Personalization: IoT can be used to gather data about customer behavior and preferences. This data can then be utilized to create personalized offers and services, enhancing customer engagement.

- Automated Asset Valuation: IoT-enabled devices can provide ongoing information about the condition and value of collateral assets, ensuring that the collateral’s value is accurately assessed throughout the loan term.

- Remote Consultations: IoT devices could facilitate remote consultations between borrowers and loan officers, streamlining the application and approval process.

- Smart Contracts and Loan Automation: IoT can trigger smart contracts to automate certain loan processes, such as collateral release or interest adjustments, based on predefined conditions being met.

- Predictive Maintenance for Collateral: IoT sensors on equipment or assets can predict maintenance needs, helping lenders anticipate potential disruptions that might impact loan repayment.

- Energy Efficiency Analysis: For businesses seeking loans for energy efficiency projects, IoT devices can provide data on energy consumption patterns and potential cost savings, aiding lenders in evaluating loan requests.

- Location-Based Services: IoT can offer location-based services, allowing lenders to provide location-specific offers, financial products, or services to potential borrowers.

GAO Helps Customers Comply with Standards, Mandates & Regulations of Credit Intermediation and Related Activities Industry

GAO RFID Inc. has helped many companies in credit intermediation and related activities industry to deploy RFID, BLE, IoT and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- RFID Use in Asset Tracking and Loan Collateral Management

- Industry-Specific RFID Compliance Regulations

- Proximity Marketing Using BLE: Regulatory Considerations

- BLE for Indoor Navigation and Location-Based Services

- IoT Data Privacy and Consent Regulations

- Industry-Specific IoT Security Frameworks

- FAA (Federal Aviation Administration) Regulations for Commercial Drones

- ICAO (International Civil Aviation Organization

U.S. Government Regulations

- Banking Regulations

- Consumer Credit Regulations

- Mortgage Regulations

- Credit Union Regulations

- CUA) Regulations

- Online Lending and Fintech Regulations

- Small Business Lending Regulations

- Securities Regulations

- Privacy and Data Security Regulations

Canadian Government Regulations

- Credit Reporting Regulations

- Digital Lending Regulations

- Data Privacy and Security Regulations

- Fair Lending Regulations

- Small Business Lending Support Regulations

- Debt Collection Regulations

- Mortgage Servicing and Foreclosure Regulations

- Fintech Regulatory Sandbox

- Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) Regulations

- Responsible Lending Regulations

- Regulatory Technology (RegTech) Framework

- Third-Party Risk Management Regulations

GAO’s Software Provides API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in credit intermediation and related activities industry:

Personnel Management:

- Human Resources Strategy and Planning

- Job Descriptions and Role Clarification

- Employee Onboarding and Training

- Performance Management

- Compensation and Benefits

- Diversity, Equity, and Inclusion (DEI) Initiatives

- Employee Wellbeing and Work-Life Balance

- Conflict Resolution and Employee Relations

- Ethics and Compliance Training

- Leadership Development

- Remote Work Management

- Employee Engagement and Recognition

- Workplace Health and safety

- Employee Development and Training

- Personnel Records and Data Management

Equipment Management:

- Office Equipment

- Communication Equipment

- Security Equipment

- Data Management Equipment

- Financial Equipment

- Collaboration Tools

- Customer Interaction Tools

- Security and Compliance Tools

- Remote Work Equipment

- Asset Tracking and Management Tools

- Automation and Process Optimization Tools

- Data Privacy and Security Equipment

- Training and Development Equipment

- Disaster Recovery Equipment

- Energy Efficiency Equipment

Access Control:

- Physical Access Control

- Visitor Management

- Access Zones and Restrictions

- Remote Access Control

- Data Access Controls

- Secure Password Policies

- Surveillance and Monitoring

- Access Control Policies and Procedures

- Physical Barriers and Locks

- Access Control Software Solutions

- Vendor and Third-Party Access Management

- Emergency Access Protocols

Warehouse Management:

- Inventory Tracking and Management

- Storage Optimization

- Security Measures

- Asset Identification and Labeling

- Asset Maintenance and Condition Monitoring

- Inventory Reporting and Analytics

- Workflow Optimization

- Employee Training and Safety

- Technology Integration

- Audit and Compliance

- Disaster Preparedness

- Vendor and Supplier Management

- Reverse Logistics

- Environmental Considerations

Supply Chain Management:

- Supplier Selection and Qualification

- Vendor Relationship Management

- Inventory Planning and Management

- Demand Forecasting

- Logistics and Transportation

- Risk Management

- Quality Control and Assurance

- Supplier Contracts and Agreements

- Ethical Sourcing and Sustainability

- Supply Chain Visibility

- Collaboration and Integration

- Emergency Preparedness

- Regulatory Compliance

- Supply Chain Analytics

Other Applications:

- Customer Relationship Management (CRM) Systems

- Document Management and Digitalization

- Business Intelligence and Analytics

- Regulatory Compliance Solutions

- Mobile Banking and Finance Apps

- Data Security and Fraud Prevention

- Artificial Intelligence (AI) in Underwriting

- Virtual Reality (VR) for Customer Engagement

- Blockchain and Cryptocurrency Integration

- E-Commerce Integration for Lending

- Customer Self-Service Portals

- Real-Time Payment Processing

- Social Media and Online Reputation Management

- Data Analytics for Cross-Selling

GAO has enabled its customers to make use of some of the leading software and cloud services in credit intermediation and related activities industry. Below are some popular software and cloud services in credit intermediation and related activities industry.

SAP SuccessFactors, Workday, Oracle Human Capital Management (HCM), ADP Workforce Now, BambooHR, Kronos Workforce Ready, UltiPro, PeopleSoft HCM, Fiix, eMaint CMMS, UpKeep, Dude Solution MaintenanceEdge, Hippo CMMS, EZOfficeInventory, Asset Panda, MPulse Maintenance Software

GAO has worked with some of the leading technology companies in credit intermediation and related activities industry to provide integrated RFID, BLE, IoT, and drone solutions to customers. Here are some of the technology leaders in credit intermediation and related activities industry.

IBM Corporation, Microsoft Corporation, Salesforce, Oracle Corporation, SAS Institute, Cisco Systems, Siemens, Honeywell International, Schneider Electric, ABB Group

Case Studies of RFID Applications

Below are some RFID application cases in credit intermediation and related activities industry:

A financial institution implements RFID tags on valuable assets, such as laptops, tablets, and office equipment, to streamline inventory management. The RFID system enables real-time tracking of assets’ locations, reducing the chances of loss or theft and improving asset utilization.

A lending company utilizes RFID tags on loan collateral, such as vehicles or machinery. This allows the lender to monitor the condition and location of the collateral throughout the loan term, reducing the risk of default due to negligence or misuse.

A credit intermediary deploys RFID technology to track and manage physical documents and records. RFID tags attached to loan files and contracts facilitate easy retrieval, minimize errors in document handling, and enhance compliance with document retention policies.

A credit union implements RFID-enabled access control systems to enhance security within its branches and offices. Employees and authorized personnel can use RFID-enabled cards or badges for secure entry, limiting access to sensitive areas.

A fintech company integrates RFID technology into its customer engagement strategy. RFID-enabled cards or devices are provided to customers, allowing them to quickly access services, participate in loyalty programs, and receive personalized offers.

A credit intermediary uses RFID tags on office supplies and consumables. This helps streamline inventory replenishment, reduce overstocking, and ensure that essential supplies are readily available when needed.

A financial technology company deploys RFID technology to track and manage assets within its data centers. This includes servers, networking equipment, and other infrastructure components, ensuring efficient asset utilization and maintenance.

Many applications of RFID by GAO can be found here:

Case Studies of IoT Applications

Below are some IoT application cases in credit intermediation and related activities industry:

An investment firm implements IoT-enabled asset tracking solutions to monitor the movement and condition of high-value assets, such as equipment, vehicles, and collateral. Real-time data helps optimize asset utilization, prevent loss, and improve decision-making.

A bank deploys IoT sensors in its branches and ATMs to monitor foot traffic, queue lengths, and ATM status. This data is used to allocate resources effectively, reduce wait times, and enhance customer experience.

A credit intermediary integrates IoT cameras, motion detectors, and access control systems to enhance security within its premises. Real-time alerts and video feeds are monitored remotely, ensuring rapid response to any unauthorized access or unusual activities.

A fintech company installs IoT sensors in its physical customer interaction points, such as kiosks or digital signage. By analyzing customer behavior and preferences, the company tailors its services and offerings to individual customers.

An equipment financing company employs IoT-enabled sensors to monitor the condition and location of loan collateral, such as industrial machinery. This reduces the risk of defaults by ensuring proper maintenance and timely interventions.

An online lending platform gathers IoT-generated data from borrowers’ connected devices (e.g., smartphones, wearables) to assess their creditworthiness. Behavioral patterns and data trends contribute to more accurate risk assessments.

An insurance company leverages IoT data from clients’ properties or vehicles to offer personalized insurance rates. Real-time data about asset usage and health allows for dynamic risk pricing.

A trade finance company deploys IoT sensors to monitor the movement and condition of goods in transit. The data is shared with financial partners to optimize supply chain financing and reduce payment delays.

Case Studies of Drone Applications

Below are some drone application cases in credit intermediation and related activities industry:

A credit intermediary uses drones to conduct property assessments for collateral purposes. Drones capture high-resolution images and videos of properties, providing lenders with accurate data for assessing property value and condition before approving loans.

Drones are employed to perform site inspections for commercial lending. Lenders can remotely survey construction progress, building conditions, and infrastructure for projects they are financing.

Drones equipped with sensors monitor assets such as agricultural machinery or construction equipment financed by credit intermediaries. Real-time data on asset usage, location, and condition is transmitted, enabling lenders to ensure proper maintenance and compliance.

Credit intermediaries that offer insurance products use drones to assess damage after natural disasters. Drones capture imagery of affected areas, helping insurers process claims more quickly and accurately.

Drones assist credit intermediaries in managing large property portfolios. By capturing aerial views and property conditions, lenders can make informed decisions about property management and investment.

In cases of loan default, credit intermediaries use drones to locate and recover assets. Drones equipped with GPS and imaging technology aid in locating and verifying the condition of the assets.

Drones facilitate remote client engagement by providing virtual property tours and inspections. Clients can view properties or assets they are considering for financing without the need for physical visits.

Drones are used to assess the environmental impact of projects being considered for financing. This technology aids lenders in evaluating the potential risks associated with certain projects.

GAO RFID Systems & Hardware for Credit Intermediation and Related Activities Industry

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including credit intermediation and related activities industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration and panic button:

GAO’s BLE technology is suitable for many industries, including credit intermediation and related activities industry.

UHF (Ultra High Frequency) RFID

GAO offers the largest selection of UHF RFID readers for various industries, including credit intermediation and related activities industry:

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including credit intermediation and related activities industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including credit intermediation and related activities industry:

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including credit intermediation and related activities industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- UHF 860 – 960 MHz RFID Modules

- 13.56 MHz High Frequency RFID Modules

- 125 kHz Low Frequency RFID Modules

In collaboration with its sister company GAO Tek Inc, a wide selectioon of high quality drones are offered:

The RFID systems by GAO are highly popular for clients in credit intermediation and related activities industry:

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include ATMs (Automated Teller Machines, POS (Point of Sale) Terminals, Check Scanners, Cash Counting Machines, Safe Deposit Boxes, Security Systems, Coin Counters, Digital Signature Devices, Loan Origination Systems, Mobile Banking Devices, Financial Calculators, Currency Authentication Devices, Document Scanners, Biometric Authentication Devices, Credit Card Embossing Machines, Data Encryption Devices, Loan Collateral Evaluation Tools, Customer Self-Service Kiosks, Interactive Whiteboards, Loan Servicing Platforms.

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

Furthermore, GAO provides the customization of RFID tags, RFID readers, BLE beacons and BLE gateways, IoT, drones, and systems and consulting services for credit intermediation and related activities industry and for various industries in all metropolitans in the U.S. and Canada: https://gaorfid.com/services.

GAO Makes Efforts to Satisfy Customers

Large Choice of Products

In order to satisfy the diversified needs of their corporate customers, GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drones, testing and measurement devices, and network products.

Overnight Delivery

In order to shorten the delivery to our customers, GAO has maintained a large stock of its products and is able to ship overnight within continental U.S. and Canada.

Local to Our Customers

We are located in both the U.S. and Canada. We travel to customers’ premises if necessary. Hence, we provide a very strong local support to our customers in the U.S. and Canada. Furthermore, we have built partnerships with some integrators, consulting firms and other service providers in different cities to further strengthen our services. Here are some of the service providers in Sub-Industry we have worked with to serve our joint customers:

- Consulting Firms

- IT Services Providers

- Fintech Solution Providers

- Enterprise Software Providers

- System Integrators

- Managed IT Service Providers

- Cybersecurity Firms

- Cloud Service Providers

- Deloitte

- Accenture

- PricewaterhouseCoopers (PwC)

- Ernst & Young (EY)

- KPMG

- Capgemini

- Cognizant

- Infosys

- CGI Group

- Tata Consultancy Services (TCS)

- Wipro

- BDO Consulting

GAO Has Served Credit Intermediation and Related Industry Extensively

GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drone, testing and measurement devices, and network products.

GAO’s products and technologies have helped its customers in credit intermediation and related activities Industry to achieve success in Fintech, Digital Transformation, AI (Artificial Intelligence), Blockchain, RegTech, Data Analytics, Open Banking, Neobanks, Robo-Advisors, Customer-Centric, API Economy, Cybersecurity, Personalization, Mobile Banking, Peer-to-Peer Lending, Contactless Payments, Remote KYC (Know Your Customer), ESG (Environmental, Social, Governance), NFTs (Non-Fungible Tokens), Embedded Finance.

GAO RFID Inc. has deployed RFID, BLE and IoT projects for many companies in credit intermediation and related activities industry, including many in its various divisions such as:

- Commercial Banking: Traditional banking services provided to individuals, small businesses, and large corporations, including loans, savings accounts, and credit facilities.

- Consumer Lending: Offering loans and credit to individuals for various purposes, such as mortgages, auto loans, personal loans, and credit cards.

- Investment Banking: Services related to raising capital for businesses, mergers and acquisitions, underwriting securities, and providing financial advice to companies.

- Asset Management: Managing investment portfolios on behalf of individuals, institutions, and funds, aiming to maximize returns while managing risks.

- Credit Unions: Member-owned financial cooperatives that provide banking services similar to traditional banks but are governed by their members.

- Mortgage Banking: Specializing in originating, servicing, and managing mortgage loans.

- Microfinance Institutions: Providing financial services, including credit, to low-income individuals and microenterprises in underserved areas.

- Peer-to-Peer Lending: Online platforms that match individual lenders with borrowers, eliminating the need for traditional financial intermediaries.

- Insurance Services: Providing various insurance products, including life, health, property, and casualty insurance, to manage financial risks.

- Financial Technology (Fintech): Innovations in technology that disrupt and enhance financial services, including digital payments, robo-advisors, and blockchain solutions.

- Regulatory and Compliance Services: Legal and consulting services that help financial institutions adhere to regulations and compliance standards.

- Data Analytics and Business Intelligence: Using data to gain insights into customer behavior, risk assessment, and business performance.

- Accounting and Auditing Services: Ensuring accurate financial reporting, compliance, and auditing for financial institutions.

- Real Estate and Property Services: Providing property valuation, appraisal, and real estate-related financial services.

- Economic and Financial Research: Analyzing market trends, economic indicators, and financial data to inform decision-making.

- Payment Processing and Networks: Handling electronic payment transactions, including credit card processing and payment gateways.

- Legal Services: Providing legal counsel and services related to financial transactions, contracts, and regulatory matters.

- Technology Providers: Offering software solutions, hardware, and IT services tailored to the financial industry’s needs.

GAO’s technologies enable its customers in credit intermediation and related activities industry to effectively track their workforces such as Loan Officer, Credit Analyst, Mortgage Broker, Financial Advisor, Branch Manager, Underwriter, Loan Processor, Relationship Manager, Teller, Collections Specialist, Risk Manager, Compliance Officer, Investment Advisor, Customer Service Representative, Account Manager, Operations Manager, Loan Originator, Portfolio Manager, Credit Counselor, Wealth Manager and effectively track operational assets such as ATM (Automated Teller Machine), POS Terminal (Point of Sale Terminal), Check Scanner, Cash Counting Machine, Safe Deposit Box, Security System, Coin Counter, Digital Signature Device, Loan Origination System, Mobile Banking Device, Financial Calculator, Currency Authentication Device, Document Scanner, Biometric Authentication Device, Credit Card Embossing Machine, Data Encryption Device, Loan Collateral Evaluation Tool, Customer Self-Service Kiosk, Interactive Whiteboard, Loan Servicing Platform.

Here are some of the leading companies in the credit intermediation and related activities industry:

- JPMorgan Chase & Co.

- Bank of America

- Wells Fargo & Co.

- Citigroup Inc.

- Goldman Sachs Group

- Morgan Stanley

- S. Bancorp

- Capital One Financial Corp.

- American Express Company

- PNC Financial Services Group

- Discover Financial Services

- TD Bank Group

- Ally Financial Inc.

- BB&T Corporation (now part of Truist Financial)

- SunTrust Banks (now part of Truist Financial)

- Santander Bank

- KeyCorp

- Regions Financial Corporation

- Fifth Third Bank

- Huntington Bancshares

- M&T Bank Corporation

- Synovus Financial Corp.

- Citizens Financial Group

- First Republic Bank

- Bank of Montreal (BMO)

- Scotiabank (Bank of Nova Scotia)

- Canadian Imperial Bank of Commerce (CIBC)

- National Bank of Canada

- Desjardins Group

- Laurentian Bank of Canada

You Are Invited to Contact Us!

If you interested in our products, services or partnering with us, please feel free to contact us by filling out this form:

or email us at sales@gaorfid.com