Related Products & Systems on Other Pages on This Website

IT Asset Tracking System | RFID Tracking by GAO (gaorfid.com)

People Tracking System for Offices | RFID Tracking by GAO (gaorfid.com)

Employee Access Control | Office Access Control (gaorfid.com)

Asset Tracking Systems Software | RFID Tracking – GAO RFID

Software for RFID Access Control Systems | RFID Tracking by GAO (gaorfid.com)

BLE | Bluetooth Low Energy | BLE Gateways & Beacons – GAO RFID

RFID Readers | Buy RFID Readers | RFID Reader Writers – GAO RFID

RFID Tags | Buy RFID Tags – GAO RFID

Tamper Proof RFID Tags | Security RFID Tags – GAO RFID

On Metal RFID Tags – All Types

RFID Sticker Tags | RFID Label Tags – GAO RFID Inc.

Overview

In the insurance industry, emerging technologies like Radio Frequency Identification, Blockchain, Internet of Things (IoT), and drones are playing increasingly significant roles in various related activities. RFID technology enables efficient asset tracking and inventory management, facilitating better risk assessment and loss prevention for insurers. Blockchain enhances data security, transparency, and trust in insurance transactions, streamlining policy issuance and claims processing. IoT devices provide real-time data on insured properties and assets, allowing insurers to offer personalized policies and adjust premiums based on actual usage patterns. Drones are revolutionizing the insurance sector by enabling remote inspections of properties and disaster-stricken areas, expediting claims handling and reducing the risk of physical assessments. As these technologies continue to advance, insurance professionals with expertise in leveraging them will be crucial for staying competitive and providing innovative solution for the clints.

GAO’s, RFID, BLE, IoT, and drone technologies have helped its customers in insurance career related industry to improve their work processes, their operations and productivity by better management of their staff, meterials and operational equipment such as computers, printers and scanners, phones and communication systems, fax machines, photocopiers, RFID and BLE tracking devices, CCTV cameras, data storage systems, data security equipment, mobile devices, GPS devices, drones, document management systems, customer relationship management (CRM) software, billing and payment processing software, analytics and reporting software, call center equipment, vehicle diagnostic tools.

Ranked as one of the top 10 global RFID suppliers, GAO RFID Inc. is based in New York City, U.S., and Toronto, Canada. GAO offers a comprehensive selection of UHF, HF (including NFC), and LF RFID (radio frequency identification) readers and tags, BLE (low energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), and traceability. Such RFID and BLE products and systems, as well as their IoT and drone technologies, have been successfully deployed for insurance career and related industry.

Applications & Benefits of GAO’s RFID, BLE, IoT & Drones for Insurance Career and Related Industry

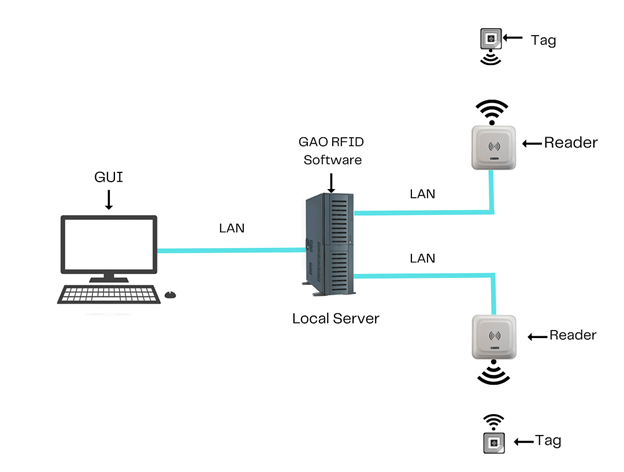

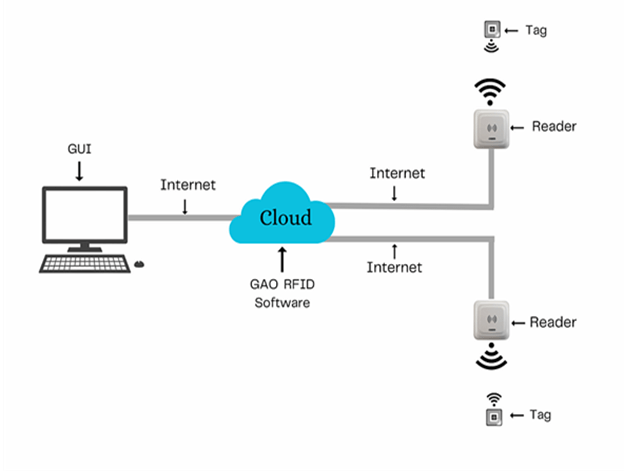

To satisfy its customers, GAO’s RFID or RFID Systems for insurance career and related industry are offered in 2 versions. One version is that its software is running on a local server that normally is on our client’s premise, and another version runs in the cloud. The cloud server could be GAO’s cloud server, client’s own cloud server or a cloud server from one of the leading cloud server providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud (formerly SoftLayer), Oracle Cloud, RedHat, Heroku, Digital Ocean, CloudFlare, Linode and Rackspace. The above illustrates GAO system for insurance career and related industry with its software running on a local server.

In Local Server Version, the software required to operate the RFID system is installed and running on a server located at the client’s premises. The server is physically present and maintained by the client themselves. This local setup gives the client more direct control over the system and its data, as the server is on-site. In contrast, the cloud server version involves hosting the RFID system software on a remote server that is accessible via the internet. The cloud server can be provided by GAO’s cloud services, the client’s own cloud infrastructure, or one of the leading cloud server providers like Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud, RedHat, Heroku, Digital Ocean, CloudFlare, Linode, and Rackspace.

In the cloud version, the RFID system is not physically present at the client’s premises; instead, it is hosted and managed in a data center operated by the chosen cloud service provider. This setup offers benefits like scalability, flexibility, and potentially lower maintenance costs, as the responsibility of managing the infrastructure lies with the cloud provider.

GAO’s RFID and BLE technologies, consisting of RFID readers, RFID tags, BLE gateways, BLE beacons, software, cloud services and their systems, have the following applications in insurance career and related industry:

- Asset Tracking and Management: RFID tags can be attached to valuable assets, such as equipment, vehicles, and office supplies. This enables insurance companies to track the location and condition of these assets in real-time, reducing the risk of loss or theft and streamlining asset management.

- Inventory Management: RFID technology can be employed to track inventory levels and monitor stock movement in insurance offices and warehouses. This ensures accurate inventory records, reduces manual errors, and facilitates efficient order management.

- Document Tracking: RFID tags can be embedded in documents and files, making it easier to locate and manage important paperwork. This streamlines document retrieval and ensures that essential records are not misplaced.

- Access Control and Security: RFID and BLE technologies can be used to implement secure access control systems. Employees can use RFID badges or BLE-enabled devices to gain access to restricted areas, enhancing the overall security of insurance company premises.

- Vehicle Identification and Tracking: Insurance companies can use RFID tags in vehicle registration plates to identify and track insured vehicles. This aids in automating toll collection, monitoring vehicle movements, and providing valuable data for risk assessment.

- Customer Interaction and Engagement: BLE beacons can be strategically placed in insurance offices or public spaces to push relevant information and offers to customers’ smartphones. This enables personalized engagement and improves customer satisfaction.

- Telematics and Usage-Based Insurance: BLE technology can be utilized to create telematics solutions that collect data on driving behavior, vehicle usage, and performance. Insurance companies can use this data to offer personalized insurance policies based on the actual risk profile of the insured.

- Claims Management: RFID and BLE technologies can assist in streamlining the claims process by automating data collection and verification. For example, they can be used to quickly assess and document damages to insured assets or vehicles.

- Safety and Risk Management: RFID and BLE sensors can be deployed to monitor workplace safety and mitigate potential risks in insurance company offices and field operations.

- Environmental Monitoring: RFID and BLE sensors can be used for environmental monitoring, such as temperature and humidity tracking, to ensure the safety and proper storage of sensitive items like artworks or valuable documents.

GAO’s drone technologies find the following applications in insurance career and related industry:

- Property Inspection: Drones can be used to assess and inspect properties for insurance purposes, especially in cases of claims or policy underwriting. Drones equipped with high-resolution cameras can capture images and videos of properties from various angles, providing insurers with a comprehensive view of the property’s condition.

- Claims Assessment: After an incident, such as a natural disaster or accident, drones can be deployed to survey the affected area and assess damages quickly. This expedites the claims process and helps insurers process claims more efficiently.

- Risk Assessment: Drones can help insurance companies assess the risk of insuring certain properties or areas. By analyzing data gathered from drone surveys, insurers can make more informed decisions on insurance premiums and coverage.

- Catastrophe Response: In the event of a natural disaster or large-scale incident, drones can be used to perform rapid damage assessments over a wide area. This information is crucial for insurers to plan their response and allocate resources effectively.

- Underwriting Support: Drones can provide detailed information on the condition and features of properties during the underwriting process. This aids insurers in accurately determining policy terms and pricing.

- Roof Inspections: Drones equipped with thermal imaging cameras can identify roof leaks and insulation issues that may not be visible to the naked eye. Insurers can use this data to address potential risks and reduce claims related to property damage.

- Crop Insurance: In agriculture-related insurance, drones can be used to monitor crops, assess crop health, and estimate yield potential. This data helps in crop insurance underwriting and claim verification.

- Surveillance and Fraud Detection: Drones can be employed to monitor areas with a high risk of fraudulent activities, such as staged accidents or false claims. The aerial view provided by drones can aid in identifying suspicious patterns or behaviors.

- Liability Investigations: In cases of accidents or liability claims, drones can capture visual evidence and recreate the scene to determine fault and liability accurately.

- Loss Prevention and Safety Inspections: Drones can be used to conduct safety inspections in high-risk areas, such as industrial sites, to identify potential hazards and prevent accidents.

GAO’s IoT technologies, consisting of IoT sensors, sensors networks and systems, find the following applications in the insurance career and related industry:

- Usage-Based Insurance (UBI): IoT sensors can be installed in vehicles to collect data on driving behavior, such as speed, acceleration, braking, and mileage. This data allows insurance companies to offer personalized insurance policies based on the actual risk profile of the insured, encouraging safer driving habits.

- Home Monitoring: IoT sensors can be used in homes to monitor various aspects, including security, water leakage, smoke, and temperature. Insurers can incentivize homeowners to implement such systems by offering discounts on insurance premiums, as it reduces the risk of damage and claims.

- Health and Wellness Tracking: IoT wearables and sensors can be utilized to track policyholders’ health and wellness data. This information can be used to promote healthier lifestyles and offer health insurance policies that align with individuals’ specific needs.

- Property Security and Risk Management: IoT sensors can be employed to monitor properties and assess potential risks, such as fire, theft, or environmental hazards. Insurers can use this data to recommend risk mitigation strategies and offer appropriate coverage.

- Fleet Management: For commercial insurance, IoT sensors can be installed in vehicles and assets to monitor their condition, location, and performance. This data helps insurers assess risk and optimize fleet management.

- Predictive Maintenance: IoT sensors can be used in commercial properties and equipment to monitor maintenance needs proactively. This minimizes the risk of breakdowns and enables insurers to provide maintenance-related coverage.

- Environmental Monitoring: IoT sensors can track environmental factors like weather, air quality, and water levels. This data is valuable for insurers assessing environmental risks and providing coverage for businesses susceptible to natural disasters.

- Loss Prevention: IoT sensors can be integrated into security systems and alarms, allowing for prompt detection and response to potential threats, reducing the likelihood of losses and claims.

- Supply Chain and Cargo Tracking: IoT sensors can be used to monitor goods during transportation, providing real-time data on location, temperature, and other environmental conditions. This data helps mitigate risks and provide more accurate coverage for cargo shipments.

- Worker Safety: IoT wearable devices can be utilized to monitor workers’ safety conditions in hazardous environments, ensuring compliance with safety protocols and reducing workplace accidents.

GAO Helps Customers Comply with Standards, Mandates & Regulations of Insurance Career and Related Industry

GAO RFID Inc. has helped many companies in insurance career and related industry to deploy RFID, BLE, IoT and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- RFID Standards & Mandates Compliance

- BLE Standards & Mandates Compliance

- IoT Standards & Mandates Compliance

- Drone Standards & Mandates Compliance

U.S. Government Regulations

- Affordable Care Act (ACA)

- Health Insurance Portability and Accountability Act (HIPAA)

- Federal Insurance Contributions Act (FICA)

- Employee Retirement Income Security Act (ERISA)

- Fair Credit Reporting Act (FCRA)

- National Flood Insurance Program (NFIP)

- National Association of Insurance Commissioners (NAIC)

- Medicare/Medicaid Regulations

- Securities and Exchange Commission (SEC)

- Consumer Financial Protection Bureau (CFPB)

Canadian Government Regulations

- Insurance Companies Act (Canada)

- Canadian Council of Insurance Regulators (CCIR)

- Office of the Superintendent of Financial Institutions (OSFI)

- Financial Consumer Agency of Canada (FCAC)

- Personal Information Protection and Electronic Documents Act (PIPEDA)

- Canada Health Act

- Automobile Insurance Regulations

- Workers’ Compensation Regulations

- Anti-Money Laundering (AML) Regulations

- Insurance Licensing and Registration Regulations

GAO’s Software Provides API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in insurance career and related industry:

Personnel Management:

- Recruitment and Selection

- Training and Development

- Performance Management

- Compensation and Benefits

- Employee Relations

- Workforce Planning

- Compliance and Regulations

- Employee Engagement and Retention

- Diversity and Inclusion

- Succession Planning

- Health and Safety

Equipment Management:

- Equipment Acquisition and Inventory

- Equipment Maintenance and Repairs

- Equipment Tracking and Monitoring

- Equipment Replacement and Upgrades

- Equipment Insurance and Risk Management

- Equipment Disposal and Asset Retirement

Access Control:

- Access Control Policies and Procedures

- User Authentication and Authorization

- Role-Based Access Control (RBAC)

- Access Control Lists (ACLs)

- Access Monitoring and Logging

- Identity and Access Management (IAM) Solutions

- Two-Factor Authentication (2FA)

- Access Control for Sensitive Data and Information

- Access Control Reviews and Audits

- Access Control Compliance and Regulations

Warehouse Management:

- Warehouse Layout and Organization

- Inventory Control and Tracking

- Warehouse Security Measures

- Warehouse Safety Protocol

- Warehouse Staff Training and Development

- Warehouse Technology and Automation

- Warehouse Efficiency and Productivity

- Warehouse Maintenance and Repairs

- Warehouse Performance Metrics and KPIs

- Warehouse Risk Management and Insurance

Supply Chain Management:

- Product Distribution and Channel Management

- Insurance Underwriting and Risk Assessment

- Policy Administration and Management

- Claims Processing and Settlement

- Reinsurance Coordination

- Data Management and Analytics

- Technology Integration and Platforms

- Vendor and Partner Management

- Compliance and Regulatory Adherence

- Supply Chain Optimization and Efficiency

Other Applications:

- Claims Management

- Vehicle Telematics

- Risk Assessment

- Wearable Devices for Health Insurance

- Property Monitoring

- Personalized Insurance Plans

- Inventory Tracking

- Supply Chain Management

- Fraud Prevention

- Disaster Response and Recovery

GAO has enabled its customers to make use of some of the leading software and cloud services in insurance career and related industry. Below are some of popular software and cloud services in insurance career and related industry:

Policy Administration Systems, Customer Relationship Management (CRM) Software, Claims Management Systems, Rating Engines, Document Management Systems, Business Intelligence and Analytics Tools, Compliance and Regulatory Software, Cloud Services, Cybersecurity Solutions, Insurtech Solutions, Data Analytics and Business Intelligence (BI) Software, Insurance Quoting Software.

GAO has worked with some of the leading technology companies in insurance career and related industry to provide integrated RFID, BLE, IoT, and drone solutions to customers. Here are some of the technology leaders in insurance career and related industry:

Guidewires, Applied Systems, Duck Creek Technologies, Insurity, Vertafore, Majesco, Sapiens, EIS Group, FINEOS Corporation, Instanda, IBM, Accenture, Verisk Analytics, CoreLogic, PwC (PricewaterhouseCoopers), SAS, Microsoft, Oracle.

Case Studies of RFID Applications

Below are some RFID application cases in insurance career and related industry:

RFID (Radio Frequency Identification) technology was being explored and utilized in various applications in the insurance industry and related sectors. However, specific case studies may vary based on ongoing developments and advancements in the field. Below are some examples of how RFID applications have been used in the insurance career and related industry:

An insurance company implemented RFID tags on high-value assets, such as laptops and medical equipment, to track their locations and status in real-time. This improved asset visibility, reduced losses due to theft or misplacement, and streamlined inventory management processes.

In the property insurance sector, RFID technology was used to monitor the structural health of buildings. RFID sensors placed within the buildings collected data on environmental conditions, vibrations, and structural integrity. This data aided insurers in assessing risks accurately and providing tailored coverage for commercial properties.

An insurance company introduced RFID-enabled telematics devices in vehicles to gather data on driving behavior and mileage. The collected data allowed insurer to offer usage-based insurance policies, providing incentives for safe driving and personalized coverage based on individual driving habits.

In the auto insurance sector, RFID tags were used to expedite the claims assessment process. After an accident, a drone equipped with RFID readers scanned the RFID tags on the damaged vehicles, capturing detailed data on the extent of damage. This data was then used to accelerate the claims settlement process.

An insurance company implemented RFID technology in document tracking to improve efficiency in claims processing and policy administration. RFID tags were placed on documents, allowing them to be easily located, tracked, and retrieved when needed, minimizing processing times and reducing manual errors.

RFID technology was integrated into insurance fraud detection systems to verify the authenticity of insured assets. RFID tags embedded in insured items enabled real-time tracking, ensuring that the assets claimed in a policy were genuine and reducing the risk of fraudulent claims.

Many applications of RFID by GAO can be found here:

Case Studies of IoT Applications

IoT (Internet of Things) applications in the insurance industry were gaining momentum, and several case studies demonstrated their potential impact. Below are some examples of IoT applications in the insurance career and related industry:

A major auto insurance company introduced IoT-enabled telematics devices that were installed in policyholders’ vehicles. These devices collected data on driving behavior, such as speed, acceleration, braking, and mileage. The collected data allowed the insurer to offer usage-based insurance policies, where premiums were determined based on actual driving habits. Safe drivers were rewarded with lower premiums, fostering safer driving practices and reducing the number of claims.

A home insurance provider collaborated with smart home device manufacturers to offer policyholders discounts for installing IoT devices such as smart security cameras, water leak detectors, and smoke alarms. The devices were integrated with the insurer’s system, and in the event of a potential risk or emergency, alerts were sent to both the homeowners and the insurer. This proactive approach helped prevent potential damages and losses, and policyholders enjoyed reduced premiums for their active risk mitigation efforts.

A commercial property insurance company deployed IoT sensors in office buildings and industrial facilities to monitor various environmental factors, including temperature, humidity, air quality, and water leaks. The real-time data collected from these sensors provided insurers with insights into potential risks and vulnerabilities. This data-driven risk assessment enabled insurers to offer more accurate coverage and helped clients proactively address safety and security concerns.

A health insurance company partnered with a wearable device manufacturer to offer IoT wearables to policyholders. These devices tracked health-related data such as activity levels, heart rate, and sleep patterns. Policyholders who opted to use the wearable devices were incentivized with lower premiums and rewards for maintaining a healthy lifestyle. Additionally, the data from wearables enabled the insurer to offer personalized health and life insurance coverage based on individual health metrics.

An agricultural insurance provider used IoT sensors to monitor soil moisture levels, weather conditions, and crop health in farmers’ fields. The data collected from these sensors was analyzed to assess potential risks, such as drought, excessive rainfall, or pest infestations. The insurer offered customized insurance plans for farmers based on real-time data, providing coverage against specific risks that could impact crop yield.

An insurance company utilized IoT-enabled drones equipped with cameras and sensors for property claims inspection. After an incident, such as a natural disaster or fire, drones were deployed to assess the damage and capture high-resolution images. This expedited the claims process, improved accuracy in claim assessment, and reduced the need for manual inspections in hazardous areas.

Case Studies of Drone Applications

Drones have been used for various purposes, ranging from claims assessment to risk inspection. Below are some examples of drone applications in the insurance career and related industry:

After a severe storm, an insurance company used drones to assess the damage to properties and infrastructure. Equipped with high-resolution cameras, the drones captured images and videos of affected areas, providing insurers with real-time visual data. This expedited the claims assessment process, enabling faster claim settlements for policyholders.

A property insurance company utilized drones to conduct roof inspections for underwriting purposes. Drones equipped with thermal imaging cameras detected hidden roof damage and potential risks, such as leaks or structural issues. The data collected from these inspections helped underwriters make informed decisions and accurately assess risks before issuing policies.

An insurance company operating in regions prone to natural disasters, such as floods or wildfires, employed drones to monitor and assess environmental risks. Drones equipped with environmental sensors collected data on factors like temperature, humidity, and air quality, aiding insurers in offering appropriate coverage and mitigating risks for policyholders.

Insurers used drones for surveillance and security purposes to protect high-value assets, construction sites, and commercial properties. Drones equipped with cameras and sensors provided real-time monitoring, detecting potential security breaches and preventing unauthorized access, reducing the likelihood of insurance claims.

In hard-to-reach or hazardous locations, such as offshore oil rigs or construction sites, drones were deployed for risk inspections. The drones captured aerial views of these areas, helping insurers assess potential risks and ensure adequate coverage for insured parties working in challenging environments.

Agricultural insurers utilized drones to monitor crops and assess potential damages due to weather events or pests. Drones equipped with specialized cameras collected data on crop health, enabling insurers to offer coverage tailored to specific agricultural risks.

GAO RFID Systems & Hardware for Insurance Career and Related Industry

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including insurance career and related industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration and panic button:

GAO’s BLE technology is suitable for many industries, including insurance career and related industry.

UHF (Ultra High Frequency) RFID

GAO offers the largest selection of UHF RFID readers for various industries, including insurance career and related industry:

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including insurance career and related industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including insurance career and related industry:

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including general medical and surgical hospitals industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- Find Your 860-960 MHz RFID Module

- Find Your 13.56 MHz High Frequency RFID Module

- Find Your 125 kHz RFID Reader Modules

In collaboration with its sister company GAO Tek Inc, a wide selectioon of high quality drones are offered:

The RFID systems by GAO are highly popular for clients in insurance career and related industry:

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include vehicles, equipment, valuables and high-value items documents and files inventory, property and real estate, health and wellness devices, crop and agriculture, goods in transit, physical security assets.

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

Furthermore, GAO provides the customization of RFID tags, RFID readers, BLE beacons and BLE gateways, IoT, drones, and systems and consulting services for insurance career and related industry and for various industries in all metropolitans in the U.S. and Canada: Services

GAO has Served Insurance Career and Related Extensively

GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drone, testing and measurement devices, and network products.

GAO’s products and technologies have helped its customers in Insurance Career and Related Industry to achieve success inRFID (Radio-Frequency Identification), BLE (Bluetooth Low Energy), IoT (Internet of Things), drones in insurance, testing and measurement devices, network products for insurance, telemedicine, AI-driven heal solutions, wearable insurance technology, big data analytics, and blockchain in insurance.

Generally, GAO RFID Inc. might have deployed projects for insurance companies and related industry divisions that involve utilizing RFID, BLE, or IoT technologies for:

- Asset Tracking: Implementing RFID or IoT-based asset tracking systems to monitor valuable assets, such as vehicles, equipment, and high-value items, to improve asset management and reduce losses.

- Document Management: Utilizing RFID tags or BLE beacons to track and manage important documents and files, improving document retrieval and organization.

- Inventory Management: Deploying RFID or BLE technology to track inventory levels, automate stock management, and enhance overall inventory accuracy.

- Claims Processing: Using RFID or IoT technologies to streamline claims processing, track claim status, and assess damages or losses more efficiently.

- Security and Access Control: Implementing RFID or BLE access control systems to secure physical premises and restrict access to authorized personnel.

- Health and Wellness Monitoring: Employing IoT devices to track policyholders’ health and wellness data, enabling usage-based insurance models and personalized coverage.

- Risk Assessment: Utilizing RFID or IoT sensors to assess risks in various contexts, such as environmental monitoring, workplace safety, and property inspection.

- Fleet Management: Deploying IoT and RFID solutions to monitor and manage fleets of vehicles, providing real-time data on performance, maintenance needs, and driver behavior.

- Customer Engagement: Leveraging BLE beacons to offer location-based services, personalized offers, and promotional messages to customers visiting insurance offices or events.

- Telematics Solutions: Implementing IoT and BLE technologies to collect and analyze telematics data for usage-based insurance and vehicle monitoring.

Here are some leading companies in the Insurance Career and Related Industry:

- Munich RE

- AXA

- State Farm Insurance

- Zurich

- Farmers Insurance

- AIA(American International Assurance) Company Limited

- AIG(American International Group)

- Swiss RE

- Assurant

- Allstate

- American National

- Aviva

- Berkshire Hathaway Homeservices

- CHUBB

- Cigna

- MetLife

- Intact

- Sompo

- Libert Mutual Insurance

- Aflac

- Desjardins

- Nationwide

- Prudential

- New York Life

- Allianz

- The Hartford

- Travelers

- Mercury Insurance

- Am Trust Financial

- Sun Life Financial