Overview

The securities, commodity contracts, and other financial investments and related activities industry encompasses a wide range of financial activities. This industry involves buying, selling, and trading various financial instruments, such as stocks, bonds, commodities, and derivatives. It also includes activities related to investment management, financial advisory services, and brokerage services. Companies within this industry may operate as investment banks, brokerages, asset management firms, commodity traders, and hedge funds. The industry plays a crucial role in facilitating capital allocation, risk management, and investment opportunities for individuals, corporations, and institutional investors in the global financial markets.

GAO’s RFID, BLE, IoT, and drone technologies have helped its customers in securities, commodity contracts, and other financial investments and related activities Industry to improve their work processes, their operations and productivity by better management of their staff, materials and operational equipment such as computers, servers, financial software, communication tools, market data subscriptions, high-speed internet, analytical tools, risk management software, security systems, trading terminals, multi-monitor setups, printers, scanners, financial calculators, office furniture, presentation tools, and ergonomic equipment.

Ranked as a top 10 global RFID supplier and based in New York City and Toronto, GAO RFID Inc offers a wide choice of RFID (radio frequency identification) readers and tags at ultra high frequency (UHF), high frequency (HF, including NFC) and low frequency (LF), BLE (Low Energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), traceability. Such RFID and BLE products and systems, together with its IoT and drone technologies, have been widely used in securities, commodity contracts, and other financial investments and related activities industry.

Applications & Benefits of GAO’s RFID, BLE, IoT & Drones for Securities, Commodity Contracts, and Other Financial Investments and Related Activities industry

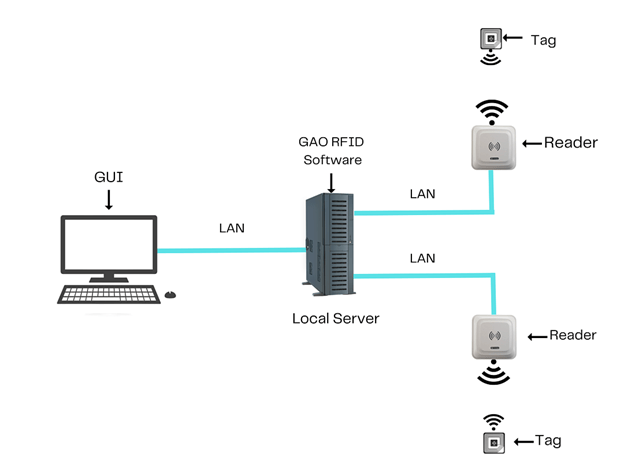

To satisfy its customers, GAO’s RFID or RFID Systems for securities, commodity contracts, and other financial investments and related activities industry are offered in 2 versions. One version is that its software is running on a local server that normally is on our client’s premise, and another version runs in the cloud. The cloud server could be GAO’s cloud server, client’s own cloud server or a cloud server from one of the leading cloud server providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud (formerly SoftLayer), Oracle Cloud, RedHat, Heroku, Digital Ocean, CloudFlare, Linode and Rackspace. The above illustrates GAO system for securities, commodity contracts, and other financial investments and related activities industry with its software running on a local server.

The above illustrates GAO system for securities, commodity contracts, and other financial Investments and related activities with its software running in cloud.

GAO’s RFID and BLE technologies, consisting of RFID readers, RFID tags, BLE gateways, BLE beacons, software, cloud services and their systems, have the following applications in securities, commodity contracts, and other financial investments and related activities industry:

- Asset Tracking: RFID tags can be used to track and manage high-value assets, such as computer equipment, office furniture, and other valuable items within the organization.

- Document and Record Management: RFID tags can be applied to important documents and records to streamline their tracking, organization, and retrieval processes.

- Access Control and Security: RFID access cards or tags can be used to control access to sensitive areas within financial institutions and restrict unauthorized entry.

- Inventory Management: RFID technology enables real-time monitoring of inventory levels, ensuring accurate stock counts and timely replenishment.

- Supply Chain Management: RFID tags can be attached to shipments and containers, allowing for better visibility and traceability throughout the supply chain.

- Personnel Tracking: RFID badges or wristbands can be issued to employees, contractors, or visitors for attendance tracking and ensuring compliance with security protocols.

- Cash and Asset Transportation Security: RFID technology can be integrated into secure cash boxes or asset containers for monitoring and securing valuables during transportation.

- Anti-counterfeiting Measures: RFID tags with unique identifiers can be used to verify the authenticity of high-value items, such as luxury goods or financial instruments, to prevent counterfeiting.

- Data Center Management: RFID can be used to track IT assets, servers, and equipment within data centers, ensuring efficient management and preventing unauthorized access.

- Automated Payment Systems: RFID-enabled payment cards or mobile wallets can facilitate fast and secure transactions at financial events, conferences, or payment kiosks.

GAO’s drone technologies find the following applications in the securities, commodity contracts, and other financial investments and related activities industry:

- Security and Surveillance: Drones equipped with cameras and sensors can be used for enhanced security and surveillance of financial institutions, office premises, and critical infrastructure, helping to deter potential threats and monitor suspicious activities.

- Asset Inspections: Drones can conduct aerial inspections of financial assets, such as real estate properties, construction sites, and infrastructure investments, providing detailed visual data for assessment and decision-making.

- Risk Assessment: Drones equipped with specialized sensors can be deployed for risk assessment purposes, such as monitoring disaster-prone areas, assessing environmental risks, and evaluating potential investment risks.

- Infrastructure and Facility Management: Drones can assist in managing large financial facilities, such as data centers or warehouses, by conducting inventory checks, equipment inspections, and monitoring maintenance needs.

- Geospatial Mapping: Drones can create high-resolution geospatial maps of land, properties, or infrastructure, aiding in land valuation, asset tracking, and portfolio management.

- Site Surveys for Investment: Drones can be used to conduct site surveys for potential investment opportunities, providing investors with real-time data on locations and properties.aa

- Disaster Response and Recovery: Drones can be deployed during natural disasters or emergencies to assess damages, evaluate insurance claims, and aid in disaster recovery planning.

- Data Collection and Analysis: Drones equipped with advanced sensors can collect environmental, agricultural, or economic data relevant to financial investments, facilitating informed decision-making.

- Marketing and Promotion: Drones can be used for creative marketing purposes, capturing aerial footage of properties or projects to promote investment opportunities.

- Compliance and Regulation: Drones can assist financial institutions in conducting compliance checks and monitoring adherence to regulatory standards, especially in large or remote locations.

GAO’s IoT technologies, consisting of IoT sensors, sensors networks and systems, find the following applications in the securities, commodity contracts, and other financial investments and related Activities industry:

- Smart Surveillance and Security: IoT sensors and cameras can be deployed for real-time monitoring and security of financial institutions, trading floors, and data centers, enabling quick response to potential threats.

- Asset Tracking and Management: IoT devices can track and manage high-value assets, such as equipment, vehicles, and inventory, improving asset utilization and minimizing losses.

- Automated Trading and Algorithmic Solutions: IoT-enabled devices can facilitate algorithmic trading strategies by providing real-time data and insights for rapid decision-making.

- Smart Payment Systems: IoT can be integrated with payment devices and wearables, allowing for seamless and secure transactions, especially in contactless payment scenarios.

- Remote Monitoring of Investment Portfolios: IoT sensors can be applied to monitor physical assets in investment portfolios, such as real estate or infrastructure, enabling better portfolio management.

- Environmental Monitoring for Risk Assessment: IoT sensors can provide real-time environmental data for assessing investment risks related to climate change, natural disasters, and other environmental factors.

- Supply Chain Optimization: IoT-enabled devices can track goods and shipments throughout the supply chain, improving transparency, reducing delays, and optimizing logistics for commodity contracts.

- Customer Behavior Analysis: IoT data can be used to analyze customer behavior and preferences, aiding in the development of personalized financial services and investment recommendations.

- Data Center Management: IoT sensors can monitor data center infrastructure, optimizing cooling, power consumption, and equipment performance for efficient operations.

- Smart Contracts and Blockchain Integration: IoT devices can trigger and execute smart contracts automatically, streamlining contract-based financial activities while leveraging blockchain technology for security and transparency.

- Energy Efficiency and Cost Savings: IoT devices can optimize energy consumption in financial facilities, leading to cost savings and sustainable practices.

- Predictive Maintenance: IoT sensors can predict equipment failures or maintenance needs, reducing downtime and operational disruptions.

GAO Helps Customers Comply with Standards, Mandates & Regulations of Securities, Commodity Contracts, and Other Financial investments and Related Activities industry

GAO RFID Inc. has helped many companies in securities, commodity contracts, and other financial investments and related activities industry to deploy RFID, BLE, IoT and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- ISO/IEC 18000 series

- EPCglobal standards

- ISO/IEC 15693

- ISO/IEC 14443

- Bluetooth SIG standards

- IEEE 802.15.4

- MQTT

- CoAP

- HTTP

- LWM2M

- ASTM F38

- ISO 21384

US Government Regulations

- Securities Act of 1933

- Securities Exchange Act of 1934

- Commodity Exchange Act (CEA)

- Investment Company Act of 1940

- Investment Advisers Act of 1940

- Dodd-Frank Wall Street Reform and Consumer Protection Act

- Sarbanes-Oxley Act of 2002

- Gramm-Leach-Bliley Act (GLBA)

- Financial Industry Regulatory Authority (FINRA) rules

- Commodity Futures Trading Commission (CFTC) regulations

Canadian Government Regulations

- Canadian Securities Administrators (CSA) Regulations

- Investment Industry Regulatory Organization of Canada (IIROC) Rules

- Mutual Fund Dealers Association of Canada (MFDA) Rules

- Canadian Derivatives Clearing Corporation (CDCC) Rules

- Securities Act (Canada)

- Commodity Futures Act (Ontario)

- Canadian Investor Protection Fund (CIPF) Rules

- Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA)

GAO Software Provides Easy Integration with API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in securities, commodity contracts, and other financial investments and related activities industry such as:

Personnel Management:

- Employee Records and HR Management

- Compliance Training and Certification

- Performance Management

- Talent Acquisition

Equipment Management:

- IT Asset Management

- Office Equipment Inventory

- Physical Asset Tracking

- Maintenance and Repairs

Access Control:

- Physical Security

- Identity Verification

- Visitor Management

- Secure Data Access

Warehouse Management:

- Inventory Tracking

- Order Management

- Quality Control

Supply Chain Management:

- Supplier Management

- Logistics and Transportation

- Demand Forecasting

Other Applications:

- Compliance and Regulatory Reporting

- Data Security and Privacy

- Disaster Recovery and Business Continuity

- Document Management

- Customer Relationship Management (CRM)

- Trading Platforms and Algorithmic Trading

- Fraud Detection and Risk Management

GAO has enabled its customers to make use of some of the leading software and cloud services in securities, commodity contracts, and other financial investments and related activities industry such as

- Oracle HCM

- Cloud

- SAP SuccessFactors

- Workday HCM

- ADP Workforce Now

- Paycom

- UltiPro

- BambooHR

- Kronos Workforce Central

- PeopleSoft HCM

- Sage HRMS

GAO has worked with some of the leading technology companies in securities, commodity contracts, and other financial investments and related activities industry in to provide integrated its RFID, BLE, IoT and drone solutions to customers. Here are some of the technology leaders in securities, commodity contracts, and other financial investments and related activities industry such as

- Microsoft 365 (formerly Office 365)

- Google Workspace (formerly G Suite)

- Zoho People, ADP Vantage HCM

- Amazon Web Services (AWS)

- Microsoft Azure, Google Cloud, IBM Cloud

- Oracle Cloud, and Salesforce Financial Services Cloud

Case Studies of RFID Applications

Below are some RFID application cases in securities, commodity contracts, and other financial investments and related activities industry.

This case study focuses on how an investment bank implemented RFID technology to track and manage their high-value assets, such as computer equipment and documents, across multiple office locations.

This study explores how a financial services firm leveraged RFID technology to monitor the movement of commodities throughout the supply chain, enhancing transparency and efficiency in their commodity contract operations.

This case study showcases how a Canadian investment firm utilized RFID technology to monitor and manage high-value assets in their investment portfolio, improving asset visibility and risk assessment.

This study examines how a securities firm in Canada implemented RFID systems in their warehouse to optimize stock control processes, reducing errors and improving stock management.

This case study illustrates how a financial institution in the USA integrated UFH RFID technology into their automated trading algorithms, enabling fast and data-driven investment decisions.

This study demonstrates how a US-based financial services company adopted UFH RFID technology to secure and monitor commodity contracts throughout the supply chain, reducing risks and enhancing transparency.

This case study explores how a Canadian financial institution implemented UFH RFID for personnel tracking and attendance management, streamlining workforce management processes.

his study highlights how a Canadian investment firm utilized UFH RFID technology to enhance access control and identity verification in their data centers and secure areas.

Case Studies of IoT Applications

Below are some IoT application cases in securities, commodity contracts, and other financial investments and related activities industry.

A major investment firm in the USA deploys IoT sensors to gather real-time data on environmental factors like weather conditions, air quality, and natural disasters that could impact investments in industries such as agriculture, insurance, and real estate. This data integration helps the firm make more informed and timely investment decisions, reducing risks and enhancing sustainability practices.

An energy trading company in the USA implements IoT-enabled devices in the supply chain for monitoring the movement and quality of commodities like oil, gas, and minerals. The IoT sensors track the commodities from production to delivery, providing transparency and efficiency in the execution of commodity contracts.

A Canadian financial institution incorporates IoT technology to create smart offices that optimize energy consumption, space utilization, and employee comfort. IoT sensors are used to control lighting, heating, and cooling systems based on occupancy and environmental conditions, leading to cost savings and improved employee productivity.

A Canadian securities firm explores the combination of IoT and blockchain technology to create digital tokens representing real-world assets such as real estate properties or artwork. Investors can securely and transparently trade these tokens, unlocking new investment opportunities and liquidity for traditionally illiquid assets.

Case Studies of Drone Applications

Below are some drone application cases securities, commodity contracts, and other financial investments and related activities industry.

A large investment firm in the USA uses drones equipped with high-resolution cameras to conduct aerial surveys of properties, infrastructure, and assets that are part of their investment portfolios. The drone surveys provide real-time visual data, helping investors and analysts make informed decisions about the potential risks and opportunities associated with their investments.

A commodities trading company in the USA utilizes drones to inspect and monitor the supply chain of commodities like agricultural products and raw materials. Drones equipped with various sensors (e.g., thermal, multispectral) are deployed to assess crop health, storage conditions, and transportation infrastructure, enabling the firm to make better-informed trading decisions.

A Canadian investment group deploys drones to conduct environmental risk assessments of potential natural resource investments, such as mining or forestry projects. Drones collect data on environmental impact factors like deforestation, water quality, and wildlife habitats, helping the investors gauge the sustainability and long-term viability of their investments.

In Canada, REITs employ drones to inspect and monitor their real estate assets, including commercial properties and residential developments. Drones with thermal imaging capabilities are used to identify potential maintenance issues, such as roof leaks or heat loss, allowing the REITs to proactively address property maintenance and reduce risks.

GAO RFID Systems & Hardware for sub-industry

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including securities, commodity contracts, and other financial investments and related activities industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration and panic button:

GAO’s BLE technology is suitable for many industries, including sub-industry.

UHF (Ultra High Frequency) RFID

GAO offers the largest selection of UHF RFID readers for various industries, including securities, commodity contracts, and other financial investments and related activities industry:

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including securities, commodity contracts, and other financial investments and related activities industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including securities, commodity contracts, and other financial investments and related activities industry:

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including securities, commodity contracts, and other financial investments and related activities industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- Find Your 860-960 MHz RFID Module

- Find Your 13.56 MHz High Frequency RFID Module

- Find Your 125 kHz RFID Reader Modules

In collaboration with its sister company GAO Tek Inc, a wide selection of high quality drones are offered:

The RFID systems by GAO are highly popular for clients in securities, commodity contracts, and other financial investments and related activities industry:

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include

Put here, from the AI answer to questions below

list of special equipment used by Securities, commodity contracts, and other financial investments and related activities industry

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

Furthermore, GAO provides the customization of RFID tags, RFID readers, BLE beacons and BLE gateways, IoT, drones, and systems and consulting services for Securities, commodity contracts, and other financial investments and related activities industry and for various industries in all metropolitans in the U.S. and Canada:

GAO has served securities, commodity contracts, and other financial investments and related activities industry extensively

GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drone, testing and measurement devices, and network products.

GAO’s products and technologies have helped its customers in to achieve success in securities, commodity contracts, and other financial investments and related activities industry. The products include: artificial intelligence (ai), machine learning, big data, internet of things (iot), blockchain, cloud computing, robotic process automation (rpa), data analytics, cybersecurity, digital transformation, fintech, regtech, smart contracts, predictive analytics, quantum computing, biometrics, augmented reality (ar), virtual reality (vr), 5g technology, and edge computing.

GAO RFID Inc. has deployed RFID, BLE and IoT projects for many companies in securities, commodity contracts, and other financial investments and related activities industry., including many in its various divisions such as financial sector, including Banking and Financial Services, Investment Banking, Asset Management, Stock Exchanges, Commodity Trading, Insurance and Risk Management, Wealth Management, Financial Technology (Fintech), Hedge Funds, Venture Capital, Private Equity, Credit and Lending Services, Real Estate Investment, Pension Funds, and Mutual Funds. Through its cutting-edge technologies, GAO RFID Inc. helps these financial institutions optimize their operations, enhance security, and streamline processes to meet the industry’s ever-evolving needs. With a proven track record of successful deployments, GAO RFID Inc. continues to be a trusted partner for companies seeking innovative solutions in the financial sector.

GAO’s technologies enable its customers in securities, commodity contracts, and other financial investments and related activities industry. to effectively track their workforces such as:

- Traders

- Analysts

- Portfolio Managers

- Investment Bankers

- Financial Advisors

- Risk Managers

- Quantitative Analysts (Quants)

- Compliance Officers

- Research Associates

- Operations Specialists

- Asset Managers

- Fund Managers

- Brokers

- Derivatives Traders

- Securities Sales Representatives

- Wealth Managers

- Hedge Fund Managers

- Fixed Income Analysts

- Equity Research Analysts

- Private Equity Professionals

and effectively track operational assets such as

- Trading Terminals

- Bloomberg Terminals

- Risk Management Software

- Portfolio Management Systems

- Order Management Systems (OMS)

- Execution Management Systems (EMS)

- Market Data Feeds

- Algo Trading Platforms

- Settlement Systems

- Clearing and Custodial Systems

- Market Surveillance Tools

- Compliance Software

- Financial Analytics Software

- Research Platforms

- Customer Relationship Management (CRM) Systems

- Accounting Software

- Pricing and Valuation Tools

- Trade Reporting Systems

- Collateral Management Systems

- Trading Communication Systems (e.g., Instant Messaging platforms)

Leading US Companies in the Securities, Commodity Contracts, and Other Financial investments and Related Activities industry – East:

- JPMorgan Chase & Co. – Investment banking and financial services.

- Bank of America Corporation – Banking and wealth management services.

- Goldman Sachs Group, Inc. – Investment banking and asset management.

- Morgan Stanley – Financial advisory and wealth management.

- Citigroup Inc. – Global banking and capital markets.

- BlackRock, Inc. – Investment management and advisory services.

- Rowe Price Group – Investment management and mutual funds.

- Allianz Life Insurance Company of North America – Life insurance and annuities.

- MetLife, Inc. – Insurance and annuities.

- New York Life Insurance Company – Life insurance and retirement solutions.

- The Hartford Financial Services Group – Insurance and investment products.

- TD Ameritrade Holding Corporation – Online brokerage and financial services.

- Ameriprise Financial, Inc. – Financial planning and investment management.

- PNC Financial Services Group, Inc. – Banking and financial services.

- Principal Financial Group – Retirement and investment solutions.

- Raymond James Financial, Inc. – Investment banking and brokerage services.

Leading US Companies in the Securities, Commodity Contracts, and Other Financial investments and Related Activities industry – West:

- Wells Fargo & Co. – Banking and financial services.

- Vanguard Group – Investment management and mutual funds.

- Charles Schwab Corporation – Brokerage and financial services.

- AIG (American International Group) – Insurance and risk management.

- Prudential Financial, Inc. – Insurance and financial services.

- State Street Corporation – Custody and asset management services.

- Capital One Financial Corporation – Banking and credit card services.

- Pacific Investment Management Company (PIMCO) – Investment management.

- Farmers Insurance Group – Insurance and financial services.

- Western Asset Management Company – Investment management and fixed income.

- The Capital Group Companies, Inc. – Investment management.

- Franklin Templeton Investments – Investment management.

List of Leading Canadian Companies in the Securities, Commodity Contracts, and Other Financial investments and Related Activities industry Industry:

- Royal Bank of Canada (RBC) – Banking and financial services.

- Toronto-Dominion Bank (TD Bank) – Banking and wealth management.

- Bank of Nova Scotia (Scotiabank) – Banking and global markets.

- Bank of Montreal (BMO) – Banking and investment services.

- Manulife Financial Corporation – Insurance and financial services.

- Sun Life Financial Inc. – Insurance and wealth management.