Overview

The RFID (Radio Frequency Identification) technology in the Depository Credit Intermediation Industry has ushered in a multifaceted transformation. It empowers institutions with an array of advantages to elevate customer experience, operational efficiency, and security protocols. By enabling secure access to banking facilities and online services, RFID-enabled cards and devices bolster customer authentication, effectively curbing identity theft risks. Simultaneously, RFID-equipped payment cards and mobile devices introduce the convenience of contactless transactions, not only accelerating payment processes but also enriching customer convenience and satisfaction.

GAO’s products and technologies have helped its customers in Depository Credit Intermediation Industry to achieve success in the Internet of Things (IoT), Digital Twin, Additive Manufacturing, Electric Vehicles (EVs), Lightweight Materials, Artificial Intelligence (AI), Augmented Reality (AR), Supply Chain Visibility, Sustainable Manufacturing, Big Data Analytics, Advanced Robotics, Predictive Maintenance, Cybersecurity, Human-Machine Collaboration.

Ranked as one of the top 10 global RFID suppliers, GAO RFID Inc. is based in New York City, U.S. and Toronto, Canada. GAO offers a comprehensive selection of UHF, HF (including NFC) and LF RFID (radio frequency identification) readers and tags, BLE (Low Energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), traceability. RFID and BLE products and systems, as well as its IoT and drone technologies, have been successfully deployed for RFID Miscellaneous Manufacturing Industry. Its sister company, GAO Tek Inc. https://gaotek.com, is a leading supplier of industrial or commercial testers and analyzers, drones, and network products.

The targeted markets of both GAO RFID Inc. and GAO Tek Inc. are North America, particularly the U.S., Canada, Mexico, and Europe. As a result, this website gaorfid.com is offered in English and other major languages of North America and Europe such as Spanish, French, German, Italian, Polish, Ukrainian, Romanian, Russian, Dutch, Turkish, Greek, Hungarian, Swedish, Czech, Portuguese, Serbian, Bulgarian, Croatian, Danish, Finnish, Norwegian, Slovak, Catalan, Lithuanian, Bosnian, Galician, Slovene, Latvian, Estonian, Welsh, Icelandic, and Irish.

Applications & Benefits of GAO’s RFID, BLE, IoT & Drones in Depository Credit Intermediation Industry

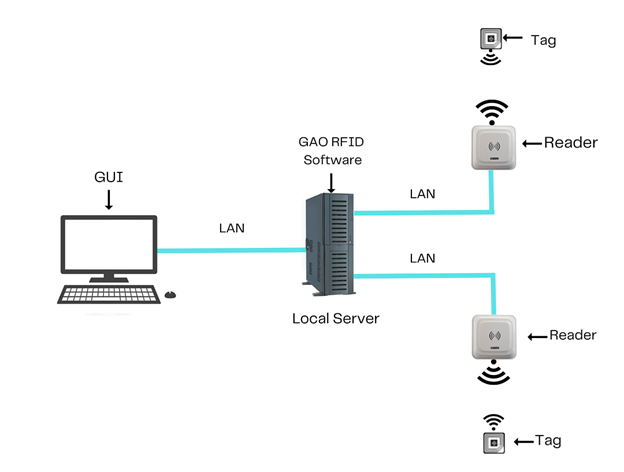

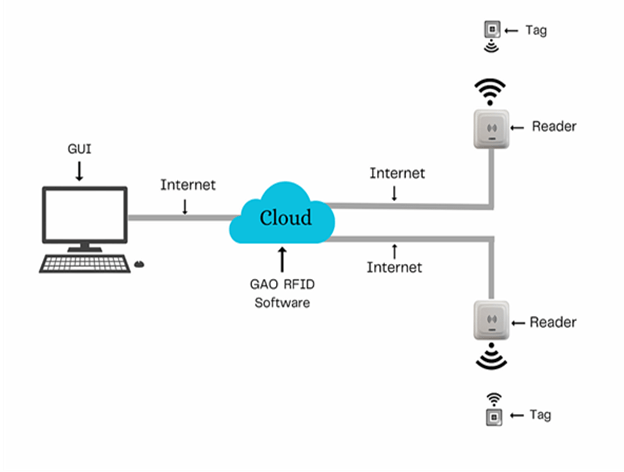

To satisfy its customers, GAO’s RFID or RFID Systems for Depository Credit Intermediation Industry are offered in 2 versions. One version is that its software is running on a local server that normally is on our client’s premises, and another version runs in the cloud. The cloud server could be GAO’s cloud server, client’s own cloud server or a cloud server from one of the leading cloud server providers such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, IBM Cloud (formerly SoftLayer), Oracle Cloud, RedHat, Heroku, Digital Ocean, Cloudflare, Linode and Rackspace. The above illustrates GAO system for Manufacturing Industry with its software running on a local server.

The above illustrates the GAO system uses Depository Credit Intermediation Industry with its software running in the cloud.

GAO’s RFID and BLE technologies, consisting of RFID readers, RFID tags, BLE gateways, BLE beacons, software, cloud services and their systems, have the following applications in Depository Credit Intermediation Industry:

- Customer Authentication and Access Control: RFID-enabled cards and BLE beacons can serve as secure identification tools, allowing customers access to banking facilities and online services while enhancing authentication protocols.

- Contactless Transactions and Payments: RFID-equipped payment cards and BLE-enabled mobile devices enable seamless and secure contactless transactions, expediting payments and improving the overall customer experience.

- Asset Tracking and Management: RFID tags and BLE beacons can be utilized to monitor valuable assets within banking premises, such as ATMs, IT equipment, and documentation, optimizing asset management and reducing losses.

- Inventory Management and Optimization: RFID technology facilitates real-time inventory tracking of banking supplies, improving accuracy and streamlining inventory management processes.

- Document Tracking and Retrieval: RFID tags and BLE beacons integrated with document management systems enhance the tracking and retrieval of important documents, improving efficiency in document-related workflows.

- Enhanced Security Measures: RFID-enabled access control systems and BLE gateways can ensure secure access to restricted areas, bolstering security for sensitive data and operations.

- Efficient Queue Management: BLE-enabled tokens or devices aid in efficient queue management, reducing wait times and enhancing the customer experience during peak service hours.

- Regulatory Compliance and Audit Trail: RFID technology assists in automating data collection processes, facilitating compliance with industry regulations and providing audit trails for transactions and access.

- Data Protection and Privacy: RFID and BLE technologies can be employed to secure sensitive customer data, devices, and networks against unauthorized access and potential breaches.

- Automated Customer Services: BLE-enabled systems and RFID-based self-service kiosks enhance customer service availability, allowing customers to access information and perform transactions conveniently.

- Remote Monitoring and Alerts: RFID readers and BLE gateways can enable remote monitoring of critical systems, triggering alerts in case of anomalies or security breaches.

- Data Analytics and Insights: RFID and BLE-generated data can be analyzed to gain insights into customer behavior, transaction patterns, and operational efficiency, supporting data-driven decision-making.

GAO’s drone technologies can be utilized in the Depository Credit Intermediation Industry:

- Security and Surveillance: Drones equipped with cameras and sensors can enhance security by monitoring large banking premises, ATM locations, and other facilities, helping to detect and prevent unauthorized access or suspicious activities.

- Site Inspection and Maintenance: Drones can be used for inspecting the exteriors of bank buildings, rooftops, and other hard-to-reach areas, aiding in maintenance planning and ensuring the safety of infrastructure.

- Remote Assessments: Drones can provide visual assessments of remote ATM locations, helping staff monitor and address issues like equipment malfunctions, vandalism, or maintenance needs.

- Emergency Response: In the event of emergencies, drones can quickly assess damage to bank properties, providing valuable information to first responders and aiding in disaster recovery efforts.

- Data Collection and Surveillance: Drones can gather data on traffic patterns around bank branches, helping institutions make informed decisions about site selection, business hours, and resource allocation.

- Marketing and Branding: Drones can capture aerial footage of bank branches for marketing purposes, showcasing the institution’s presence and enhancing its branding efforts.

- Customer Engagement: Organizing special events or promotions outdoors? Drones can capture these events from unique angles, generating engaging content for social media and customer outreach.

- Delivery Services: While less common, drones could potentially be used for delivering sensitive documents or small packages between bank branches or to customers in specific scenarios.

GAO’s IoT technologies, consisting of IoT sensors, sensors networks and systems, find the following applications in the Depository Credit Intermediation Industry:

- Environmental Monitoring: IoT sensors can track temperature, humidity, and air quality within bank premises, ensuring optimal conditions for sensitive equipment, documents, and customer comfort.

- Energy Efficiency: By deploying IoT sensors to monitor energy consumption, banks can identify inefficiencies, optimize HVAC systems, and reduce operational costs.

- Security and Surveillance: IoT sensors can be integrated with security systems, alerting personnel in real-time to unusual activities or breaches, enhancing overall facility security.

- Asset Tracking and Management: IoT sensors can track the location and status of valuable assets such as ATMs, ensuring their security and enabling efficient maintenance.

- Predictive Maintenance: IoT sensors on equipment like ATMs can collect data to predict maintenance needs, minimizing downtime and improving operational efficiency.

- Customer Flow Analysis: IoT sensors can track foot traffic within bank branches, helping to optimize staffing levels and streamline customer service.

- Queue Management: By monitoring customer queues using IoT sensors, banks can dynamically manage wait times and improve customer experience.

- Remote Monitoring: IoT sensors can remotely monitor ATM status, transaction volumes, and cash levels, enabling efficient restocking and maintenance.

- Risk Management: IoT sensors can detect water leaks or environmental changes, helping mitigate risks to sensitive documents and equipment.

- Data Analytics and Insights: The data collected by IoT sensors can be analyzed to gain insights into customer behavior, operational trends, and branch performance.

- Regulatory Compliance: IoT sensors can monitor environmental conditions required for storing sensitive documents, helping banks meet compliance standards.

- Emergency Response: IoT sensors can trigger alerts in the event of emergencies, allowing banks to quickly respond to incidents and ensure customer safety.

- Customer Engagement: IoT sensors can personalize customer experiences by triggering automated interactions based on customer proximity or preferences.

- Automated Workflows: IoT sensors can automate routine tasks like lighting and climate control, enhancing operational efficiency.

- Data-Driven Decision-Making: The insights gathered from IoT sensors can guide strategic decisions, resource allocation, and process optimization.

GAO Helps Customers Comply with Standards, Mandates & Regulations in Depository Credit Intermediation Industry

GAO RFID Inc. has helped many companies in the Depository Credit Intermediation Industry to deploy RFID, BLE, IoT and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- ISO 18000-6C

- Bluetooth SIG

- ISO/IEC 30141

- Open Connectivity Foundation (OCF)

- Industrial Internet Consortium (IIC)

- IoT Security Foundation

- FAA Regulations (U.S.)

- ASTM International standards

U.S. Government Regulations

- Bank Secrecy Act (BSA)

- Anti-Money Laundering (AML) Regulations

- Truth in Savings Act

- Truth in Lending Act

- Equal Credit Opportunity Act (ECOA)

- Fair Housing Act

- Community Reinvestment Act (CRA)

- Gramm-Leach-Bliley Act (GLBA)

- Consumer Financial Protection Bureau (CFPB) Regulations

- Office of the Comptroller of the Currency (OCC) Regulations

- Federal Reserve System (FRS) Regulations

- Federal Deposit Insurance Corporation (FDIC) Regulations

Canadian Government Regulations

- Bank Act

- Anti-Money Laundering and Anti-Terrorist Financing Regulations (AML/ATF)

- Consumer Protection Act

- Canada Deposit Insurance Corporation (CDIC) Act

- Personal Information Protection and Electronic Documents Act (PIPEDA)

- Financial Consumer Agency of Canada (FCAC) Regulations

- Office of the Superintendent of Financial Institutions (OSFI) Regulations

- Securities Act (for credit unions that offer securities)

- Canadian Payments Act

- Credit Union and Caisses Populaires Act (in provinces where credit unions are regulated)

GAO’s Software Provides API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in Depository Credit Intermediation Industry such as:

Personnel Management:

- Recruitment and Selection

- Training and Development

- Performance Evaluation and Feedback

- Employee Engagement and Retention

Equipment Management:

- Equipment Inventory and Tracking

- Preventive Maintenance Scheduling

- Equipment Calibration and Testing

- Equipment Replacement and Upgrades

Access Control:

- Secure Entry and Exit Points

- Visitor Management System

- Access Control for Restricted Areas

- Biometric Authentication

Warehouse Management:

- Inventory Control and Tracking

- Stock Replenishment and Ordering

- Shelf Life and Expiry Date Management

- Space Optimization and Layout Planning

Supply Chain Management:

- Vendor Selection and Management

- Procurement and Purchase Order Management

- Demand Forecasting and Inventory Planning

- Distribution and Logistics Optimization

Other Applications:

- Quality Assurance and Compliance Management

- Production Workflow Optimization

- Product Lifecycle Management

- Compliance and Regulatory Tracking

- Energy Management and Sustainability Monitoring

- Financial Management and Revenue Cycle Management

GAO has enabled its customers to make use of some of the leading software and cloud services in the Depository Credit Intermediation Industry. Below are some of the popular software and cloud services in Depository Credit Intermediation Industry:

FIS Core Banking Solution, Fiserv Core Banking Suite ,Jack Henry & Associates Core Banking Systems, Salesforce CRM, Microsoft Dynamics CRM, Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform, Wolters Kluwer CRA Wiz, NICE Actimize, SAS Risk Management,Moody’s Analytics Risk Management Solutions,, FICO Origination Manager, Experian PowerCurve, Plaid (for data connectivity)

GAO has worked with some of the leading technology companies in Depository Credit Intermediation Industry to provide integrated RFID, BLE, IoT, and drone solutions to customers. Here are some of the technology leaders in Depository Credit Intermediation Industry:

In the dynamic landscape of the Depository Credit Intermediation Industry, technology leaders play a pivotal role in driving innovation, efficiency, and customer-centric solutions. FIS (Fidelity National Information Services) is a prominent figure, offering a comprehensive suite of financial technology solutions. Similarly, Fiserv stands out for its versatile Core Banking Suite and a range of fintech offerings that streamline operations and enhance customer experiences. Jack Henry & Associates is recognized for its core banking systems and technology services that empower financial institutions to excel.

Case Studies of RFID Applications

Below are some RFID application cases in Depository Credit Intermediation Industry:

CreditLink Corporation, a prominent credit intermediary, deployed RFID technology to optimize their asset tracking and management process. By affixing RFID tags to high-value collateral assets such as vehicles and equipment, they established a seamless system for real-time asset monitoring. The RFID solution enabled CreditLink to remotely track the location and condition of collateral assets, ensuring accurate valuation and minimizing the risk of loss. This streamlined collateral management improved operational efficiency, expedited loan processing, and enhanced risk assessment accuracy. As a result, CreditLink achieved reduced administrative costs and increased borrower satisfaction by offering more efficient and transparent loan services.

Case Studies of IoT Applications

Below are some IoT application cases in Depository Credit Intermediation Industry.

ABC Financial Services, a prominent credit intermediary, implemented IoT technology to revolutionize risk assessment for lending. By integrating IoT sensors into borrower assets, such as machinery and equipment, they gained real-time insights into asset performance and usage patterns. These data driven insights provided a more accurate assessment of borrowers’ financial health and repayment capacity. The IoT solution allowed ABC Financial Services to proactively identify potential risks, enabling them to offer tailored loan terms and conditions. This innovative approach not only improved lending decisions but also strengthened customer relationships by offering more personalized financing options. The IoT-enabled risk assessment system positioned ABC Financial Services as a forward-thinking institution that leverages cutting-edge technology to make informed lending decisions.

Case Studies of Drone Applications

Below are some drone application cases in Depository Credit Intermediation Industry.

XYZ Credit Intermediary, a leading financial institution, deployed drone technology to enhance their property assessment process for mortgage lending. By utilizing drones equipped with high-resolution cameras, they streamlined property inspections for loan approvals. Drones captured detailed aerial imagery of properties, providing accurate visual data to assess property condition and value. This expedited the assessment timeline, reducing manual inspection efforts and improving loan processing speed. Additionally, drone data enabled a comprehensive evaluation of properties’ physical attributes and surroundings, enhancing risk assessment accuracy. As a result, XYZ Credit Intermediary experienced faster loan approvals, improved risk management, and enhanced customer satisfaction due to efficient and informed decision-making.

GAO RFID Systems & Hardware for Depository Credit Intermediation Industry

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including Depository Credit Intermediation Industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration and panic button:

GAO’s BLE technology is suitable for many industries, including the Depository Credit Intermediation Industry.

UHF (Ultra High Frequency) RFID

GAO offers the largest selection of UHF RFID readers for various industries, including Depository Credit Intermediation Industry:

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including Depository Credit Intermediation Industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including Depository Credit Intermediation Industry:

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including Depository Credit Intermediation Industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- UHF 860 – 960 MHz RFID Modules

- 13.56 MHz High Frequency RFID Modules

- 125 kHz Low Frequency RFID Modules

In collaboration with its sister company GAO Tek Inc, a wide selectioon of high quality drones are offered:

The RFID systems by GAO are highly popular for clients in Depository Credit Intermediation Industry:

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include chemical containers, equipment, vehicles, raw materials, storage tanks, processed batches, tools and accessories, product samples, documents, records, and mobile assets. The comprehensive RFID-based tracking solutions provided by GAO contribute to improved inventory control, regulatory compliance, and overall operational efficiency within the industry.

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

Furthermore, GAO provides the customization of RFID tags, RFID readers, BLE beacons and BLE gateways, IoT, drones, and systems and consulting services for Depository Credit Intermediation Industry and for various industries in all metropolitans in the U.S. and Canada:

GAO Makes Efforts to Satisfy Customers

Large Choice of Products

In order to satisfy the diversified needs of their corporate customers, GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drones, testing and measurement devices, and network products.

Overnight Delivery

In order to shorten the delivery to our customers, GAO has maintained a large stock of its products and is able to ship overnight within continental U.S. and Canada.

Local to Our Customers

We are located in both the U.S. and Canada. We travel to customers’ premises if necessary. Hence, we provide a very strong local support to our customers in the U.S. and Canada. Furthermore, we have built partnerships with some integrators, consulting firms and other service providers in different cities to further strengthen our services. Here are some of the service providers in Depository Credit Intermediation Industry we have worked with to serve our joint customers:

- TD Bank, N.A.

- Capital One Financial Corporation

- Truist Financial Corporation

- Goldman Sachs Group Inc.

- Morgan Stanley

- American Express Company

- Discover Financial Services

- Santander Bank, N.A.

- Charles Schwab Corporation

- Ally Financial Inc.

- KeyBank National Association

GAO Has Served in Depository Credit Intermediation Industry Extensively

GAO RFID Inc. and its sister company GAO Tek Inc. together offer a wide choice of RFID, BLE, IoT, drone, testing and measurement devices, and network products.

GAO’s products and technologies have played a pivotal role in assisting customers within the Depository Credit Intermediation Industry in achieving enhanced operational efficiency and quality standards. By leveraging RFID solutions, paper manufacturers have streamlined inventory management, reduced manual tracking efforts, and optimized production planning. The integration of IoT sensors has enabled real-time monitoring of equipment health, improving predictive maintenance strategies and minimizing costly downtime. Additionally, drones equipped with advanced cameras and sensors have facilitated efficient facility inspections, contributing to maintenance optimization and ensuring compliance with safety standards. GAO’s contributions extend to asset tracking, environmental monitoring, and quality control, enabling paper manufacturing companies to harness cutting-edge technologies to address industry challenges and achieve higher levels of productivity, quality, and operational excellence.

RFID-Based Inventory Management, Asset Tracking and Traceability, IoT-Enabled Monitoring, Process Automation, Quality Control and Compliance, Enhanced Customer Experience, Risk Mitigation and Safety, Efficient Recall Management.

GAO RFID Inc. has deployed RFID, BLE and IoT projects for many companies in Depository Credit Intermediation Industry, including many in its various divisions such as:

- Efficient Asset Tracking: RFID streamlines tracking of financial assets, ensuring accurate record-keeping and minimizing errors.

- Faster Transactions: RFID expedites customer interactions, reducing wait times and enhancing overall service speed.

- Secure Access Control: RFID enhances security by providing controlled access to secure areas and sensitive information.

- Automated Document Management: RFID aids in organizing and retrieving important documents, improving efficiency.

- Fraud Prevention: RFID strengthens security measures, deterring unauthorized access and fraudulent activities.

- Customer Experience: RFID speeds up account management processes, leading to improved customer satisfaction.

- Data Accuracy: RFID minimizes manual data entry errors, maintaining reliable and up-to-date financial records.

- Regulatory Compliance: RFID assists in maintaining compliance with industry regulations through automated data capture.

- Enhanced Analytics: RFID-generated data supports data analysis, enabling informed decision-making and insights.

GAO’s technologies empower businesses in the “Depository Credit Intermediation Industry” sector to efficiently monitor and manage their workforce. By utilizing RFID and BLE solutions, companies can accurately track worker locations, ensuring adherence to safety protocols and optimized task distribution. These technologies facilitate attendance tracking, enhance health and safety compliance, and streamline emergency response efforts. Real-time data from RFID and BLE devices aids in analyzing work patterns, optimizing workflows, and improving overall operational efficiency. Furthermore, GAO’s systems enable customized alerts, contact tracing during health crises, and integration with HR systems for seamless attendance and payroll management. Ultimately, GAO’s workforce tracking technologies contribute to safer working environments, regulatory compliance, and enhanced workforce management practices

Here are some of the leading companies in the Depository Credit Intermediation Industry:

- Royal Bank of Canada (RBC)

- Toronto-Dominion Bank (TD)

- Bank of Nova Scotia (Scotiabank)

- Canadian Imperial Bank of Commerce (CIBC)

- National Bank of Canada

- Desjardins Group

- JPMorgan Chase & Co.

- Bank of America

- Wells Fargo & Co.

- Citigroup Inc.

- Goldman Sachs Group Inc.

- Morgan Stanley

- S. Bancorp

- PNC Financial Services Group Inc.

- Capital One Financial Corp.

- American Express Co.

- Discover Financial Services

- TD Bank Group (TD Bank USA)

- SunTrust Banks Inc.

- Ally Financial Inc.

- Santander Consumer USA Holdings Inc.

- Citizens Financial Group Inc.

- Regions Financial Corporation

- Huntington Bancshares Inc.

- Fifth Third Bancorp

- Synchrony Financial

- KeyCorp

- M&T Bank Corporation

- Comerica Incorporated

- Northern Trust Corp.