Related Products & Systems on Other Pages on This Website

RFID Systems for Automotive Repair Organizations

RFID Systems for Automobile Dealers

Employee & Attendance Access Control System

People Tracking System for Manufacturing Facilities

Work In Process WIP Asset Tracking System

BLE | Bluetooth Low Energy | BLE Gateways & Beacons – GAO RFID

RFID Readers | Buy RFID Readers | RFID Reader Writers – GAO RFID

RFID Tags | Buy RFID Tags – GAO RFID

On Metal RFID Tags – All Types

Overview

The passenger car manufacturing industry is a sector of the automotive industry that designs, produces, and sells cars for personal use. This industry is characterized by intense competition among manufacturers, high levels of innovation, and significant investments in research and development. Major players in the industry include companies such as Toyota, Volkswagen, General Motors, Ford, and Hyundai, among others. The industry is subject to various economic factors, such as changes in consumer demand, raw material prices, and regulations, which can impact the profitability of companies operating in the sector.

GAO’s RFID, BLE, IoT, and drone technologies have helped its customers in the passenger car manufacturing industry to improve their work processes, their operations and productivity by better management of their staff, materials and operational equipment such as welding machines, robotics and automation systems, presses and stamping machines, paint booths and curing ovens, material handling equipment, inspection and testing equipment, assembly line equipment, injection molding machines for plastic components, cutting and machining tools, including cnc machines, die casting machines for metal components.

Ranked as one of the top 10 global RFID suppliers, GAO RFID Inc. is based in New York City, U.S. and Toronto, Canada. GAO offers a comprehensive selection of UHF, HF (including NFC) and LF RFID (radio frequency identification) readers and tags, BLE (Low Energy Bluetooth) gateways and beacons, and various RFID and BLE systems such as people tracking, asset tracking, access control, parking control, fleet management, WIP (work in progress), traceability. Such RFID and BLE products and systems, as well as its IoT and drone technologies, have been successfully deployed for the Passenger Car Manufacturing.

Applications & Benefits of GAO’s RFID, BLE, IoT & Drones for the Passenger Car Manufacturing

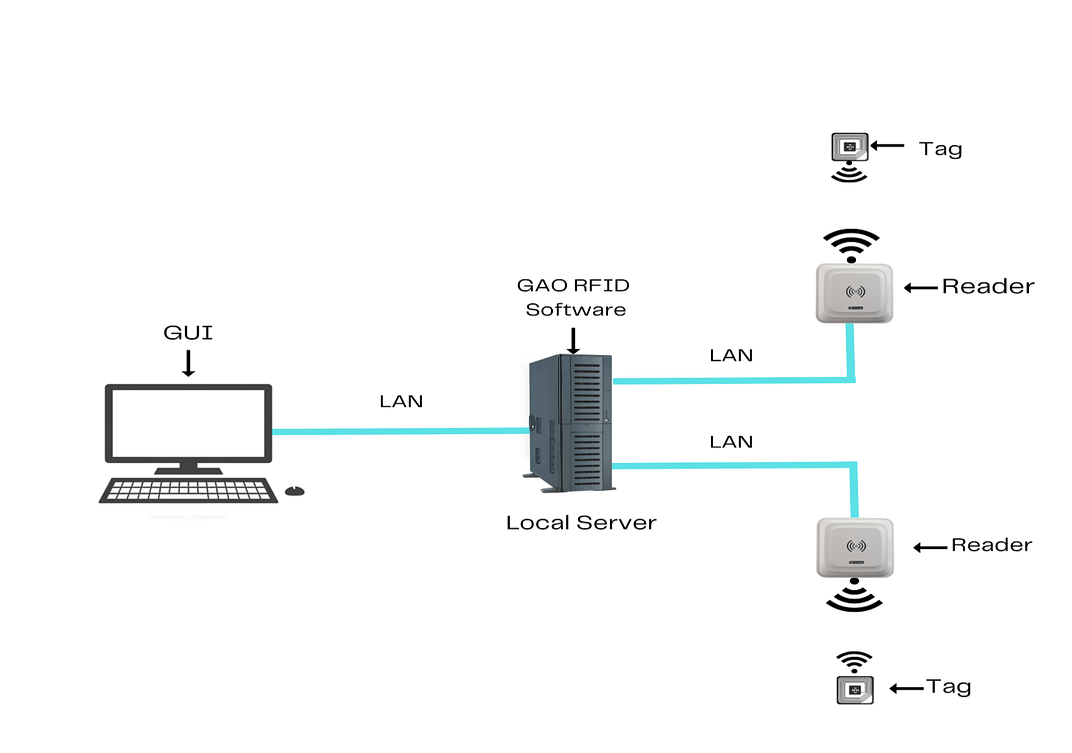

To satisfy its customers, GAO’s RFID or RFID Systems for the passenger car manufacturing industry are offered in 2 versions. One version is that its software is running on a local server, and another version is that its software runs in the cloud. The above illustrates GAO system for the passenger car manufacturing industry with its software running on a local server.

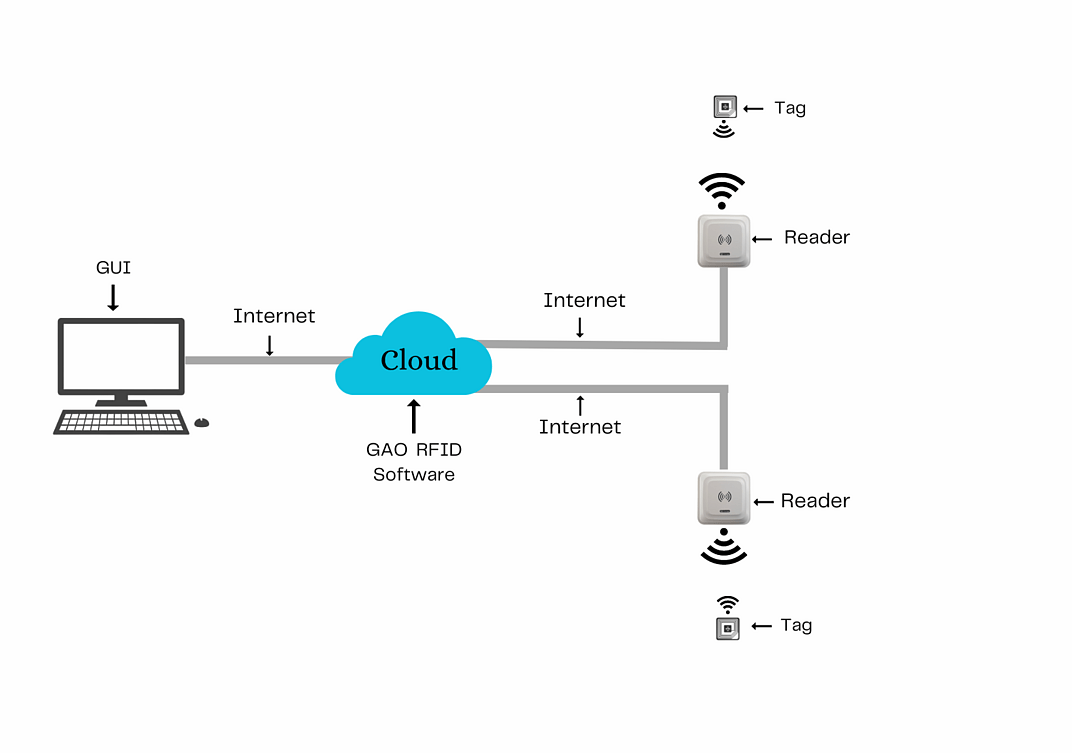

The above illustrates GAO system for the passenger car manufacturing industry with its software running in cloud.

GAO’s RFID technologies bring the many benefits to the passenger car manufacturing industry:

- Improved inventory management: GAO’s RFID technology can help manufacturers track the movement of parts and components throughout the production process, which can improve inventory management and reduce stock

- Enhanced quality control: Our RFID technology can help manufacturers track the quality of parts and components throughout the production process, which can improve quality control and reduce defects.

- Better supply chain visibility: GAO’s RFID technology can provide real-time visibility into the supply chain, which can help manufacturers identify and address supply chain bottlenecks and delays.

- Improved traceability: Our RFID technology can help manufacturers track the movement of parts and components such as engine components, electrical components and interior components (e.g., dashboard, seats, etc.) throughout the production process, which can improve traceability and reduce the risk of counterfeiting.

- Reduced labor costs: Our RFID technology can automate several manual processes, which can reduce the need for manual labor and lower labor costs.

- Increased safety: RFID technology can help manufacturers track the safety of parts and components throughout the production process, which can improve safety and reduce the risk of accidents.

GAO’s BLE technologies offer longer reading range and particularly attractive for applications with larger work spaces within the passenger car manufacturing industry:

- Real-time asset tracking: GAO’s BLE technology can help manufacturers track the location and status of assets, such as parts, tools, and equipment including power tools, hand tools, and specialized manufacturing tools (e.g., torque wrenches, measurement devices, and precision instruments), in real-time.

- Improved efficiency: Our BLE solution can automate several manufacturing processes, such as asset tracking and monitoring, which can improve efficiency and productivity.

- Enhanced safety: Our BLE technology can help manufacturers track the safety of assets throughout the production process, which can improve safety and reduce the risk of accidents.

- Reduced equipment downtime: GAO’s BLE can help manufacturers monitor the health and usage of equipment, which can reduce equipment downtime and maintenance costs.

- Better supply chain visibility: The longer reading range of GAO’s BLE technology can provide real-time visibility into the supply chain, which can help manufacturers identify and address supply chain bottlenecks and delays.

- Improved quality control: Our BLE technology can help manufacturers monitor the quality of assets throughout the production process, which can improve quality control and reduce defects.

- Increased cost savings: Our BLE solutions can help manufacturers optimize their production processes, reduce waste, and lower costs. This can lead to significant cost savings over time.

GAO’s RFID and drone technologies are often combined and such solutions offer the following benefits to the passenger car manufacturing industry:

- Improved inventory management: GAO’s RFID technology can help track the location and status of assets, such as parts and components, in real-time, while drones can be used to conduct aerial inventory scans over a large area, providing a comprehensive view of inventory levels and locations.

- Increased accuracy: The combination of our RFID and drone technology can automate inventory management processes, reducing the need for manual scanning and data entry, and freeing up personnel to focus on higher-value tasks.

- Enhanced safety: Drones can be used to conduct aerial inspections of manufacturing facilities, identifying potential safety hazards and providing a safer work environment for personnel.

- Real-time asset tracking: Our RFID technology can provide real-time tracking of assets, while drones can be used to locate and track assets in hard-to-reach areas or areas with limited visibility.

- Reduced equipment downtime: Our RFID technology can be used to monitor the health and usage of equipment, while drones can be used to conduct aerial inspections and identify potential maintenance issues before they result in equipment downtime.

- Improved quality control: GAO’s RFID technology can help monitor the quality of assets throughout the production process, while drones can be used to conduct aerial inspections and identify potential defects or issues with finished products.

- Increased cost savings: The combination of our RFID and drone technology can help manufacturers optimize their production processes, reduce waste, and lower costs. This can lead to significant cost savings over time.

Here are benefits of GAO’s IoT technologies to the passenger car manufacturing industry:

- Improved supply chain management: IoT sensors can be used to track the location and status of materials, parts, and products throughout the supply chain, providing real-time visibility and enabling manufacturers to optimize their operations.

- Enhanced asset tracking: IoT sensors can be used to track the location and usage of assets, such as tools, equipment, and vehicles, in real-time, enabling manufacturers to monitor and manage their assets more efficiently.

- Predictive maintenance: IoT sensors can be used to monitor the health and usage of equipment, such as robots and machines, and provide real-time alerts when maintenance is required. This can help reduce equipment downtime and maintenance costs.

- Improved safety: IoT sensors can be used to monitor safety conditions, such as temperature, humidity, and air quality, and provide real-time alerts when safety thresholds are exceeded. This can help improve safety for workers and prevent accidents.

- Increased efficiency: IoT sensors can be used to optimize manufacturing processes, such as assembly lines and logistics, by providing real-time data on performance and enabling manufacturers to identify and address bottlenecks and inefficiencies.

- Quality control: IoT sensors can be used to monitor product quality and identify defects or issues in real-time, enabling manufacturers to take corrective action and improve product quality.

- Energy efficiency: IoT sensors can be used to monitor energy usage and identify areas where energy can be conserved, reducing energy costs and improving sustainability.

GAO Helps Customers Comply with Standards, Mandates & Regulations of the Passenger Car Manufacturing

GAO RFID Inc. has helped many companies in the passenger car manufacturing industry to deploy RFID, BLE, IoT, and drone systems and to ensure such deployments complying with the applicable industry standards, mandates and government regulations:

RFID, BLE, IoT, & Drone Standards & Mandates

- ISO 18000-6C: This standard defines the air interface protocol for UHF RFID systems and is widely used in the automotive industry for tracking and tracing products, such as car parts and components.

- ATA Spec 2000: This standard defines the data exchange formats and communication protocols for RFID systems used in the aviation industry, which can also be applied to the automotive industry.

- EPCglobal: This is a set of RFID standards developed by GS1, a global standards organization, and is widely used in various industries, including automotive, for item-level tracking and inventory management.

- ASTM E53: This standard provides guidelines for the use of RFID technology in supply chain applications, including the automotive industry.

- Bluetooth SIG: The Bluetooth SIG has developed several profiles and specifications that are relevant to the automotive industry, such as the Bluetooth Automotive Gateway Solution (BAGS) and the Generic Attribute Profile (GATT).

- ISO/IEC 20906: This standard defines the BLE application framework for proximity services and is applicable to various industries, including the automotive industry.

- IEEE 802.15.1: This standard defines the physical and media access control (MAC) layer specifications for Bluetooth technology and is used in various industries, including the automotive industry.

- CAR 2 CAR Communication Consortium: This is an industry consortium that develops and promotes standardized communication protocols and applications for cooperative intelligent transport systems (C-ITS), which rely on wireless communication technologies such as BLE.

- AUTOSAR: This is a standard organization that develops open standards for software architecture and application interfaces in the automotive industry. AUTOSAR has developed a BLE communication stack that can be used in various applications, such as remote vehicle diagnostics and software updates.

- OCF (Open Connectivity Foundation): This is a standard organization that develops open standards for IoT interoperability, including protocols for device discovery, security, and data exchange. The OCF has developed a framework for automotive IoT, which includes a set of profiles and specifications for various use cases, such as in-vehicle infotainment, telematics, and remote vehicle management.

- AUTOSAR (AUTomotive Open System ARchitecture): This is a standard organization that develops open standards for software architecture and application interfaces in the automotive industry. AUTOSAR has developed a set of specifications for automotive IoT, including a communication stack for remote vehicle diagnostics and software updates.

- DDS (Data Distribution Service): This is a standard for real-time data exchange in distributed systems, including IoT applications. DDS can be used in various industries, including the automotive industry, for real-time monitoring and control of systems and devices.

- ANSI/ASME B46.1: This standard provides guidelines for the measurement of surface roughness in manufacturing and industrial applications. Drones equipped with sensors can be used to measure surface roughness and other parameters in the Passenger car manufacturing industry.

- US Department of Defense (DoD) RFID Mandate: This mandate requires all suppliers of the DoD to use RFID technology for tracking and managing goods and assets. The mandate includes requirements for RFID tag specifications, data format, and tag placement. The mandate has been extended to include the Passenger car manufacturing industry.

- Automotive Industry Action Group (AIAG) B11 standard: This standard provides guidelines for the use of RFID technology in the automotive industry, including the Passenger car manufacturing industry. The standard covers topics such as tag placement, data exchange, and system integration.

- General Data Protection Regulation (GDPR): This regulation, which applies to all industries including the Passenger car manufacturing industry, mandates the protection of personal data of individuals in the European Union. IoT devices that collect, process, and store personal data must comply with the GDPR requirements.

- National Institute of Standards and Technology (NIST) Cybersecurity Framework: This framework provides guidelines for organizations to manage and reduce cybersecurity risks associated with IoT devices and networks. The framework includes recommendations for identifying, protecting, detecting, responding, and recovering from cyber incidents.

- Federal Trade Commission (FTC) Guidelines for IoT: The FTC has published guidelines for the use of IoT devices and networks in various industries, including the Passenger car manufacturing industry. The guidelines include recommendations for data security, privacy, and transparency.

- California Consumer Privacy Act (CCPA): This act mandates the protection of personal data of California residents and applies to IoT devices that collect, process, or store such data.

US. Government Regulations

The passenger car manufacturing industry in the United States is subject to various federal regulations, including:

- National Highway Traffic Safety Administration (NHTSA) Regulations: The NHTSA is responsible for enforcing safety standards for passenger cars in the United States. The NHTSA sets regulations for various aspects of passenger car safety, including crashworthiness, occupant protection, fuel economy, and emissions.

- Occupational Safety and Health Administration (OSHA) Regulations: OSHA sets regulations for workplace safety in the Passenger car manufacturing industry. These regulations cover various aspects of workplace safety, including hazardous materials handling, equipment safety, and worker training.

- Federal Trade Commission (FTC) Regulations: The FTC sets regulations related to consumer protection and fair trade practices in the Passenger car manufacturing industry. These regulations cover topics such as advertising, marketing, and consumer privacy.

- Department of Transportation (DOT) Regulations: The DOT sets regulations related to transportation safety, including the transportation of passenger cars on highways and other roadways.

Canadian Government Regulations

- Transport Canada Regulations: Transport Canada is responsible for regulating and overseeing the transportation system in Canada. The agency sets regulations related to the safety and emissions of passenger cars, as well as the transportation of passenger cars on Canadian roads.

- Canadian Environmental Protection Act (CEPA): The CEPA is Canada’s primary environmental legislation. The act regulates the emissions of pollutants from vehicles, including passenger cars, and establishes requirements for the disposal of hazardous waste generated by the industry.

- Competition Bureau Regulations: The Competition Bureau is responsible for enforcing Canada’s competition laws. The bureau sets regulations related to advertising and marketing practices in the Passenger car manufacturing industry to ensure fair competition and protect consumers.

- Canadian Anti-Fraud Centre (CAFC): The CAFC is responsible for identifying, preventing, and reporting fraud in Canada. The center works closely with the Passenger car manufacturing industry to prevent fraudulent activities related to car sales and financing.

US Department of Defense (DoD)

US Department of Defense (DoD)

Federal Trade Commission (FTC)

Federal Trade Commission (FTC)

National Highway Traffic Safety Administration (NHTSA)

National Highway Traffic Safety Administration (NHTSA)

OCF (Open Connectivity Foundation)

OCF (Open Connectivity Foundation)

General Data Protection Regulation (GDPR)

General Data Protection Regulation (GDPR)

ANSI/ASME

ANSI/ASME

National Institute of Standards and Technology

National Institute of Standards and Technology

Automotive Industry Action Group

Automotive Industry Action Group

AUTOSAR

AUTOSAR

Canadian Anti-Fraud Centre

Canadian Anti-Fraud Centre

Department of Transportation (DOT)

Department of Transportation (DOT)

California Consumer Privacy Act (CCPA)

California Consumer Privacy Act (CCPA)

GAO Software Provides Easy Integration with API

GAO’s RFID and BLE software offers a free trial for both the server-based and cloud versions, and offers an API to the important systems in the Passenger car manufacturing industry such as:

Personnel management:

- Employee tracking and monitoring

- Performance management and evaluation

- Time and attendance tracking

- Training and development management

- Health and safety management

- Recruitment and onboarding

Equipment management:

- Equipment tracking and monitoring

- Preventive maintenance scheduling and management

- Equipment utilization analysis

- Calibration and certification management

- Asset management and depreciation tracking

Access control:

- Physical access control to secure areas of the facility

- Logical access control to computer systems and data

- Visitor management and tracking

Warehouse management:

- Inventory management and tracking

- Order fulfillment and tracking

- Material handling and transport management

- Dock scheduling and management

- Quality control and inspection management

Supply chain management:

- Supplier relationship management

- Procurement and purchasing management

- Logistics and transportation management

- Production planning and scheduling

- Demand forecasting and planning

Other applications:

- Quality control and inspection management

- Environmental, health, and safety management

- Energy and sustainability management

- Compliance management

- Customer relationship management

GAO has integrated its RFID, BLE, IoT, and drone systems with some of leading software and cloud services in the Passenger car manufacturing industry. Below are some of popular software and cloud services in the Passenger car manufacturing industry.

- SAP SuccessFactors: A cloud-based human capital management software that covers performance and goal management, talent acquisition, employee engagement and learning, and more.

- Oracle HCM Cloud: A human resources management software that provides a comprehensive suite of applications for managing various aspects of HR, including workforce management, talent management, payroll, and more.

- Microsoft Azure: A cloud computing service that offers solutions for IoT, machine learning, and data analytics. It can be used for equipment management and monitoring, predictive maintenance, and supply chain management.

- AWS (Amazon Web Services): A cloud computing platform that offers a range of services for IoT, data analytics, and machine learning. It can be used for asset tracking, predictive maintenance, and quality control.

- Salesforce: A cloud-based CRM (customer relationship management) platform that offers solutions for sales, marketing, and customer service. It can be used for managing customer relationships and tracking sales orders.

- ServiceNow: A cloud-based platform that offers solutions for IT service management, asset management, and human resources management. It can be used for personnel management, equipment management, and supply chain management.

- JDA Software: A provider of supply chain management and warehouse management software that offers features such as inventory management, order fulfillment, and transportation management.

- Blue Yonder: A provider of supply chain management software that includes features such as demand planning, inventory optimization, and transportation management.

- Honeywell Intelligrated: A provider of warehouse execution software that includes features such as order fulfillment, inventory management, and labor management.

- Microsoft Dynamics 365 Supply Chain Management: This cloud-based software provides features for warehouse management, transportation management, and supply chain planning. It helps to improve operational efficiency and reduce costs.

- Plex Systems: This software provides solutions for manufacturing execution, quality management, and supply chain management.

- Microsoft Dynamics 365 for Finance and Operations: This software provides solutions for supply chain management, production management, and financial management.

SAP SuccessFactor

SAP SuccessFactor

Oracle HCM Cloud

Oracle HCM Cloud

Microsoft Azure

Microsoft Azure

Microsoft Dynamics 365

Microsoft Dynamics 365

Plex Systems

Plex Systems

Microsoft Dynamics 365 Supply Chain Management

Microsoft Dynamics 365 Supply Chain Management

Honeywell Intelligrated

Honeywell Intelligrated

ServiceNow

ServiceNow

JDA Software

JDA Software

Blue Yonder

Blue Yonder

Salesforce

Salesforce

AWS

AWS

GAO has worked with some of the leading technology companies in the Passenger car manufacturing industry in to provide integrated its RFID, BLE, IoT and drone solutions to customers. Here are some of the technology leaders in the Passenger car manufacturing industry:

- Siemens: A German-based technology company providing software solutions for product lifecycle management, automation, and digitalization.

- Bosch: Bosch is a German-based multinational company that provides technology and services in various industries, including the automotive industry. The company offers a range of electronic solutions for the automotive industry, including sensors, control units, and software.

- Delphi Technologies: Delphi Technologies is a global supplier of automotive technologies, including electronics and powertrain systems. The company provides electronic solutions for passenger cars, commercial vehicles, and off-highway vehicles.

- Continental AG: Continental AG is a German-based automotive technology company that provides solutions for various automotive applications, including electronic systems, powertrain, and chassis. The company offers electronic solutions for passenger cars, commercial vehicles, and two-wheelers.

- ABB: ABB is a multinational corporation providing power and automation technologies for industries including automotive manufacturing. Its offerings include robotics, electric vehicle charging infrastructure, and energy management systems.

- Rockwell Automation: Rockwell Automation provides industrial automation solutions including control systems, motor control centers, and sensors for the Passenger car manufacturing industry.

- Honeywell: Honeywell provides software and hardware solutions for the automotive industry including supply chain management, warehouse management, and automation systems.

- Mitsubishi Electric: Mitsubishi Electric provides automation solutions including industrial robots, programmable controllers, and human-machine interfaces for the Passenger car manufacturing industry.

- Schneider Electric: Schneider Electric offers a range of industrial automation and control solutions including motor control, power distribution, and energy management.

- Yokogawa Electric: Yokogawa Electric is a multinational corporation providing control and automation solutions including process control systems and field instruments for the Passenger car manufacturing industry.

- Phoenix Contact: Phoenix Contact provides electrical engineering and automation solutions including power supplies, controllers, and connectivity for the Passenger car manufacturing industry.

- Omron Corporation: Omron Corporation provides automation solutions including robotics, sensors, and control systems for the Passenger car manufacturing industry.

Siemens

Siemens

Bosch

Bosch

Delphi Technologies

Delphi Technologies

Continental AG

Continental AG

ABB

ABB

Rockwell Automation

Rockwell Automation

Honeywell

Honeywell

Mitsubishi Electric

Mitsubishi Electric

Schneider Electric

Schneider Electric

Yokogawa Electric

Yokogawa Electric

Phoenix Contact

Phoenix Contact

Omron Corporation

Omron Corporation

Case Studies of RFID Applications

Below are some RFID application cases in the passenger car manufacturing industry:

One case of RFID application in the passenger car manufacturing industry is the use of RFID tags on parts and components to improve inventory management and supply chain visibility. For example, Toyota uses RFID tags on parts and components used in the production of their vehicles, allowing them to track inventory levels and quickly locate parts when needed. This helps to reduce waste and improve efficiency in their manufacturing process.

Another specific case of RFID application in the passenger car manufacturing industry is for tracking and managing the movement of raw materials, work-in-progress (WIP), and finished goods within the production plant. By attaching RFID tags to these items and installing RFID readers at key points in the plant, the manufacturer can monitor the progress of each vehicle through the production process, ensure that the right components are available when needed, and identify and resolve bottlenecks or other inefficiencies in the production line. This can lead to improved productivity, reduced waste, and better quality control.

Another case of RFID application in the passenger car manufacturing industry is its use in the production line to improve quality control. RFID tags are placed on parts and components as they move down the assembly line, allowing for real-time tracking of the production process. This allows manufacturers to quickly identify any quality issues and take corrective actions, reducing defects and improving overall product quality. For example, Ford Motor Company uses RFID to track the location and progress of vehicle production, reducing errors and improving efficiency.

Ford Motor Company implemented an RFID system in its Kansas City Assembly Plant to track the flow of parts for its F-150 trucks during production. The system uses RFID tags to track each part as it moves through the assembly process, from the moment it is received at the plant until it is installed on the vehicle. This helps to reduce the risk of errors, improve efficiency, and reduce waste. The system has been so successful that it has been implemented in other Ford plants as well.

One case of UHF RFID application in the passenger car manufacturing industry is at the Ford Motor Company’s assembly plant in Cologne, Germany. Ford implemented a UHF RFID system to track and manage the flow of vehicles through the manufacturing process, from the time the chassis enters the plant until the finished vehicle leaves. Each vehicle is tagged with a unique UHF RFID label that contains all of its production data, such as options, parts and assembly instructions. The RFID system enables Ford to improve its assembly line efficiency, reduce errors and increase productivity.

One specific case of UHF RFID application in the passenger car manufacturing industry is the use of UHF RFID tags for tracking and managing the movement of materials and goods in the manufacturing plant. For instance, a car manufacturer may use UHF RFID tags attached to bins or containers to track the movement of parts and supplies as they move from one area of the plant to another. The UHF RFID tags can be read automatically by fixed or mobile readers located throughout the plant, providing real-time visibility and control over inventory levels, location and status of materials, and improving overall production efficiency. This technology helps to eliminate errors, reduce waste, and optimize the supply chain.

Another specific case of UHF RFID application in the passenger car manufacturing industry is the use of UHF RFID tags for tracking and managing finished vehicles during the shipping and logistics process. The tags are affixed to each vehicle and can be read by UHF RFID readers at various points along the supply chain, allowing for real-time tracking of the vehicle’s location and status. This helps to improve visibility and accuracy of inventory management, reduce shipping errors, and increase efficiency in the distribution process.

GAO RFID Systems & Hardware for the Passenger Car Manufacturing

GAO RFID Inc. offers the largest selection of BLE gateways, BLE beacons, RFID readers, tags, antenna, printers, and integrated RFID systems for various industries, including the passenger car manufacturing industry.

BLE (Bluetooth Low Energy)

GAO offers advanced BLE gateways:

as well as versatile beacons with such important functions as temperature, humility, vibration and panic button:

GAO’s BLE technology is suitable for many industries, including the passenger car manufacturing industry.

UHF (Ultra High Frequency) RFID

GAO offers the largest selection of UHF RFID readers for various industries, including the passenger car manufacturing industry:

GAO RFID offers the widest choice of UHF RFID tags, labels, badges, wristbands for various industries, including the passenger car manufacturing industry:

and an array of antennas to address different applications:

HF (High Frequency), NFC (Near Field Communications) and LF (Low Frequency) RFID

GAO offers the largest selection of HF, NFC, and LF RFID readers for various industries, including the passenger car manufacturing industry:

- High Frequency 13.56 MHz Passive RFID Readers

- Low Frequency 134 kHz Passive RFID Readers

- Low Frequency 125 kHz Passive RFID Readers

HF, NFC and LF RFID tags, labels, badges, wristbands for various industries, including the passenger car manufacturing industry:

and antennas:

GAO also offers RFID printers:

Digital I/O adapters:

and relay controllers:

For embedded applications, GAO offers UHF, HF and LF RFID reader modules:

- UHF 860 – 960 MHz RFID Modules

- 56 MHz High Frequency RFID Modules

- 125 kHz Low Frequency RFID Modules

The RFID systems by GAO are highly popular for clients in the passenger car manufacturing industry:

Physical asset or operational equipment tracking system:

Assets that can be effectively tracked using GAO’s technologies include

- Assembly Line Robots: Automated robotic systems used for various assembly tasks, such as welding, painting, and component installation.

- Welding Equipment: Welding machines and tools used for joining metal components together during the manufacturing process.

- Press Machines: Hydraulic or mechanical presses used for stamping and forming metal sheets into car body parts.

- Painting Booths: Specialized booths or chambers equipped with paint application systems for painting car bodies.

- CNC Machines: Computer Numerical Control machines used for precision machining of components and parts.

- Test Benches: Equipment used for testing and quality control of various vehicle systems, such as engines, transmissions, and electrical components.

- Diagnostic Tools: Specialized diagnostic equipment and scanners used for testing and troubleshooting vehicle systems and electronic modules.

- Material Handling Systems: Conveyors, lifts, and robotic systems used for moving components and parts efficiently throughout the production line.

- Body-in-White (BIW) Fixtures: Jigs and fixtures used for positioning and holding car body components during welding and assembly.

- Paint Thickness Gauges: Tools used to measure the thickness of paint coatings on car bodies to ensure adherence to quality standards.

- Engine Dynamometers: Test equipment used to measure the performance and efficiency of car engines.

- Leak Detection Systems: Equipment used to detect and locate leaks in car systems, such as fuel, coolant, or air conditioning.

People or workers tracking system:

Personnel or people access control system:

Parking or vehicle control system:

GAO Has Served the Passenger Car Manufacturing Industry Extensively

GAO’s products and technologies have helped its customers in the passenger car manufacturing industry to achieve success in electric vehicles (EVs) and hybrid vehicles (HVs), autonomous vehicles (AVs) and advanced driver-assistance systems (ADAS), industry 4.0 and smart manufacturing, additive manufacturing (3D printing), lightweight materials and composites, connected cars and the Internet of Things (IoT), big data analytics and artificial intelligence (AI), augmented reality (AR) and virtual reality (VR), sustainability and circular economy, supply chain resilience and localization.

GAO RFID Inc. has deployed RFID, BLE and IoT projects for many companies in the passenger car manufacturing industry, including many in its various divisions such as

- Economy car segment: This segment is characterized by low-cost, fuel-efficient vehicles that are designed for everyday use.

- Midsize car segment: This segment includes cars that are slightly larger and more expensive than economy cars, and typically offer more comfort and features.

- Luxury car segment: This segment includes high-end, premium vehicles that are often equipped with advanced features and technologies.

- Sports car segment: This segment includes high-performance vehicles that are designed for speed and performance, and often have aggressive styling.

- Electric car segment: This segment includes vehicles that are powered by electricity, rather than traditional gasoline engines.

- Hybrid car segment: This segment includes vehicles that use a combination of gasoline and electric power to improve fuel efficiency and reduce emissions.

- SUV (sport utility vehicle) segment: This segment includes vehicles that are designed for off-road use, and typically offer high ground clearance and four-wheel drive.

- Crossover segment: This segment includes vehicles that are a hybrid between an SUV and a car, offering the benefits of both types of vehicles.

- Pickup truck segment: This segment includes vehicles that are designed for hauling and towing, and often have powerful engines and high towing capacity.

- Van and minivan segment: This segment includes vehicles that are designed for carrying passengers and cargo, and often have spacious interiors and flexible seating arrangements.

Here are some of the leading companies in the Passenger car manufacturing industry

General Motors (GM)

General Motors (GM)

Ford Motor Company

Ford Motor Company

Stellantis

Stellantis

Tesla Inc.

Tesla Inc.

Honda Motor Co.

Honda Motor Co.

Toyota Motor Corporation

Toyota Motor Corporation

Nissan Motor Co.

Nissan Motor Co.

Hyundai Motor Company

Hyundai Motor Company

Kia Motors Corporation

Kia Motors Corporation

Subaru Corporation

Subaru Corporation

BMW Group

BMW Group

Daimler AG

Daimler AG

Volkswagen AG

Volkswagen AG

Motor Corporation

Motor Corporation

Mitsubishi Motors Corporation

Mitsubishi Motors Corporation

Volvo Car Corporation

Volvo Car Corporation

Porsche AG

Porsche AG

Audi A

Audi A

Mercedes-Benz

Mercedes-Benz

Ashton Martin Inc.

Ashton Martin Inc.

Bentley Motors (Canada) Inc.

Bentley Motors (Canada) Inc.

Ferrari Canada Inc.

Ferrari Canada Inc.

Jaguar ULC

Jaguar ULC

McLaren Toronto

McLaren Toronto